[Home-ownership News]

NeighborWorks survey says Blacks and Hispanics find home-ownership difficult to obtain because of their everyday economic situation…

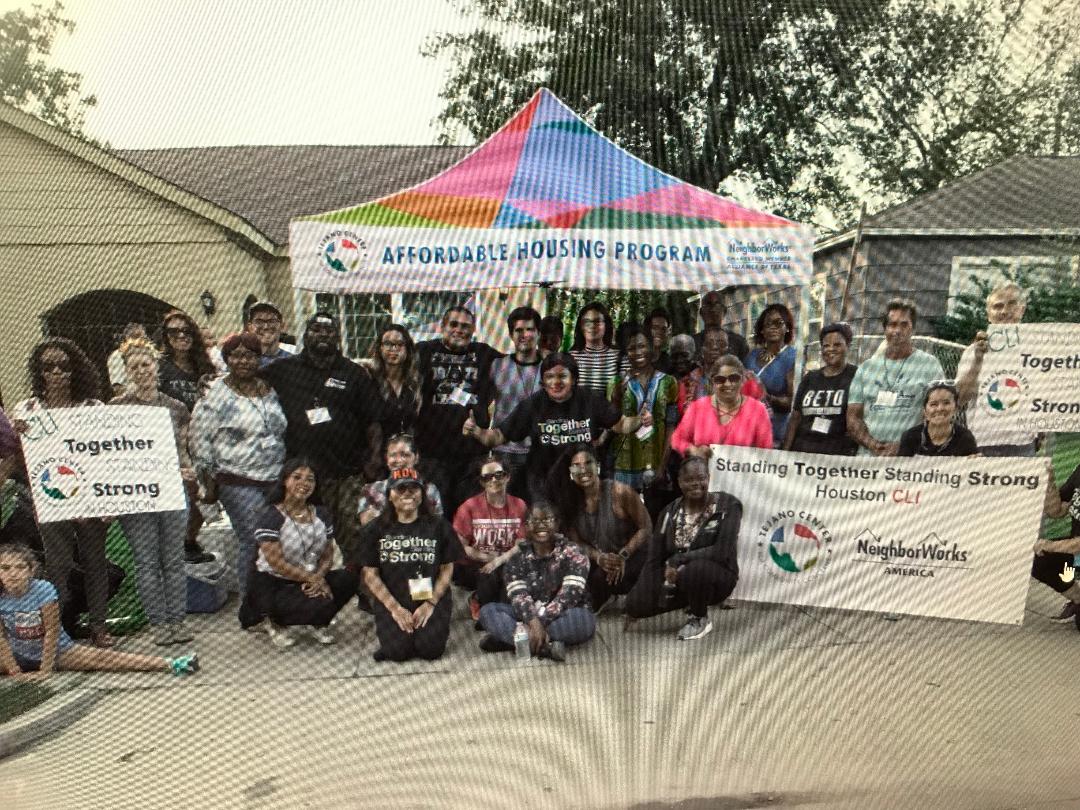

Photo: Facebook

NeighborWorks America survey says for Black and Hispanic people, bills and debt reduction take priority over long-term financial stability…

The vast majority of Americans say owning a home increases financial stability. But when it comes to priorities minorities are more concerned about meeting everyday obligations, bills and paying off debt than putting away funds for a home down payment, according to a new NeighborWorks America survey.

While 76 percent of Americans agree that owning a home increases a person’s financial stability, many people still see homeownership as beyond reach, primarily due to not understanding the process. 70 percent of U.S. adults say the homebuying process is complicated. Further, minority families, particularly Black and Hispanic people, find that they are missing the financial planning skills and knowledge to transition from renting to home ownership.

The NeighborWorks America survey offers insight into patterns and attitudes regarding homeownership and renting in the nation and the impact of debt and other dynamics on buying a home vs. renting. The study was conducted in April and May with an online panel of 1,000 U.S. adults ages 18 and older and included a separate oversample of 614 minority adults.

“While two-thirds of the general population own their home, for Black and Hispanic people, the numbers are much lower. There is a clear opportunity to help minorities bridge the wealth and attainment gap by supporting them in making good financial decisions,” said NeighborWorks America President and CEO Marietta Rodriguez. “We want to make the opportunity to pursue homeownership more available.”

Overall, Black and Hispanic people report more vulnerability and less cash on hand than Whites. 21% of Black people said their most important financial goal for 2019 is to pay bills and everyday expenses, with 6% ranking saving for a home as their No. 1 financial goal.

Among Hispanic people, 20% said paying down credit card debt is their top financial goal for 2019. Eight percent ranked saving for a down payment to buy a home as most important.

Seeking help with finances Eight out of ten Americans are unaware of any programs that provide information about the home buying process. As a result, they are likely missing out on key information that can help them make better decisions as they purchase a home. Black and Hispanic people express more interest in financial planning courses than the general population. 60 percent of Black and Hispanic people say they would be interested in financial planning classes that would help them improve their financial situation compared to 46 percent of all U.S. adults.

NeighborWorks America recommends that people interested in homeownership always work with a HUD-approved housing counselor as a first step. A housing counselor can help improve their credit score, provide information about down payment assistance and down payment assistance programs, and help evaluate their situation and create the right plan. Find a housing counselor at a local NeighborWorks organization near you.

For more information on the NeighborWorks America survey, go to www.NeighborWorks.org/housingsurvey.

About NeighborWorks America: For 40 years, Neighborhood Reinvestment Corp., a national, nonpartisan nonprofit known as NeighborWorks America, has strived to make every community a place of opportunity. Our network of excellence includes nearly 250 members in every state, the District of Columbia and Puerto Rico. NeighborWorks America offers grant funding, peer-exchange, technical assistance, evaluation tools and access to training, as the nation’s leading trainer of housing and community development professionals. NeighborWorks network organizations provide residents in their communities with affordable homes, owned and rented; financial counseling and coaching; community building through resident engagement; and collaboration in the areas of health, employment and education. In the last five years, our organizations have generated more than $34 billion in investment across the country.