[Education News\Student Loans]

CongressmanThis is a $1.5 trillion national emergency. And so many of my constituents have shared their student loan horror stories with me. It’s wrong to bury them in student loan debt that burdens them for decades, forcing them to delay getting married, starting a family, and becoming homeowners. In every congressional district across this country, thousands of constituents are overwhelmed with student loan debt, so this is truly a nation-wide problem seeking a bipartisan solution.”

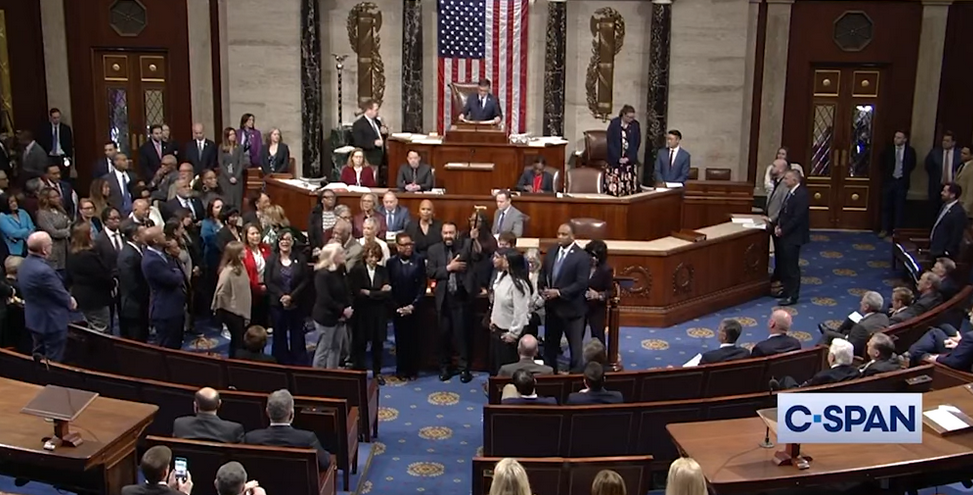

Photo: Wikimedia Commons

Congressman Wm. Lacy Clay (D) Missouri has introduced two new bills to tackle America’s student loan debt crisis.

Mr. Clay, who is the Chairman of the House Financial Services Subcommittee on Housing, Community Development and Insurance, authored H.R. 4750, The Relief from Excessive Debt Act; and H.R. 4740, The Student Debt Relief Act of 2019. The Student Debt Relief Act ensures interest rates on Direct Loans can be made more manageable and reasonable for those who are able to make payments. The RED Act addresses the most urgent financial situations and allows some student loans to be dischargeable during bankruptcy proceedings.

“These bills are targeted to address three huge problems associated with student loans,” said the Congressman. “First, my new legislation would provide relief for debtors who can pay but need lower interest rates. Second, the proposed bills encourage financial institutions, colleges, and universities to be more transparent and honest about easing the burden of student loans, refinancing those loans, and reducing the overall costs of attending college. And finally, my new bills would give some student loan borrowers the chance for a fresh start, granting them more control over their financial future.”

Obtaining a two- or four-year degree or attending professional or vocation school is an accepted path to success in America that opens the doors for a brighter future. But unfortunately, for many college graduates, there aren’t as many open doors when it comes to paying off their student loan debt. This issue undermines the future economic viability of our nation.

“This is a $1.5 trillion national emergency,” said the Congressman. “And so many of my constituents have shared their student loan horror stories with me. It’s wrong to bury them in student loan debt that burdens them for decades, forcing them to delay getting married, starting a family, and becoming homeowners. In every congressional district across this country, thousands of constituents are overwhelmed with student loan debt, so this is truly a nation-wide problem seeking a bipartisan solution. My legislation will not entirely eliminate student loan debt, but both the Student Loan Relief and the RED Act provide solutions and would represent a giant step towards easing the burden and ensuring that many low- and moderate-income borrowers are not trapped in a cycle of student loan debt and despair.”

A recent report published by The Institute for College Access and Success affirmed that student loan debt disproportionately impacts minorities and low-income households. It is difficult for individuals to compete in a job market when the consequence of seeking higher education results in a lifetime of repaying student debt instead of building wealth.