Swiss banks have in recent years returned money looted by former Nigerian rulers to the West African country after intense pressure while the UK is still to return money looted by former military strong man Sani Abacha.

(Abacha stole billions from Nigeria).

Strengthening effective strategies to fight corruption and money laundering in order to improve economic development was a key theme at the sixth annual meeting of the Eastern and Southern Africa Anti-Money Laundering Group (Esaamlg) held here in Harare recently.

Participants from the 14 member countries from the East African region to the entire southern African region, two Indian Ocean countries and others from the multilateral institutions such as the International Monetary Fund noted with concern the depressing levels of economic crimes and money laundering encountered by member states.

“It is important for governments to look at crime as a fundamental vice that ought to be crushed out completely,” said Mr. Nicholas Ncube, the Deputy Governor of the Reserve Bank of Zimbabwe opening the annual meeting. “This meeting also comes at a time when Zimbabwe has launched Project Sunrise, where tackling corruption is a top issue. We hope the delegates would be able to come up with workable strategies that contain crime.”

Zimbabwe assumed the chairmanship of Esaamlg from Zambia and the chairman of the senior officials of the grouping, Finance Secretary Mr. Willard Manungo pledged to continue fighting money laundering and the financing of terrorism by sharing experiences and developing strategies to “address this menace.” He said technological advancement in the communication field had widened the scope and extent of money laundering leaving no region unaffected. “The complexities of the challenges before us warrant greater co-ordination of the different participating agencies at the national as well as regional level.”

The participants discussed many issues related to the surveillance of banking and finance institutions, judicial systems, anti-corruption and policing strategies, the strengthening of systems and structures for co-operation with international agencies, evaluation and monitoring of individual member compliance.

“The presence of so many delegations at the meeting is a clear demonstration of our collective commitment to ensuring that our countries and the region are equipped with an effective framework that prevents money laundering and the financing of terrorism,” said Dr. Mbikusita Lewanika of Zambia, the outgoing chairman. During Zambia’s tenure, he said, Esaamlg had managed to conduct training workshops, evaluate progress made by member countries in terms of compliance to groupings’ protocols and plan of actions.

Participants at the Harare meeting proposed a plan to conduct research and document trends in corruption and the links with money laundering in the region in the next three years. Other issues which were discussed at length included the growing problem of cross-border money laundering, mutual evaluation procedures, the Esaamlg secretariat programs, co-ordination mechanism for the group and IMF, World Bank and other multilateral institutions, reports of the development of national strategies and reviewing the work of the grouping.

Patterns of corruption vary from society to society and over time and anti-money laundering experts say there is need to understand its origins, forms and effects across developing countries, the role of both international stakeholders such as politicians, business cliques and civil servants as well as external actors including western multinationals and international financial institutions.

Critics say effective anti-corruption strategies need to be tailored to the social environment in which corruption occurs and not to meet the donor criteria which is advocating for a single universal strategy to fight corruption. Corruption in Africa is not a unique phenomenon as portrayed in the mainstream international media. The mafia and the soccer match fixing scandal in Italy, the Enron scandal in the US and many others in rich and powerful countries show how corruption is widespread and fostered.

Critics accuse donors of promoting corruption in Africa by prioritizing distant issues of democracy, transparency and good governance and promoting economic reforms that refuse support to honest populations who need education, water, electricity, food and other essential services for survival. Corruption, they say, has compounded the injustices of the colonial legacy, severely impoverished the average African, left infrastructure in ruins and robbed the populace of the benefits of their natural resources.

Corruption in Africa is aided and abetted by the banking and economic policies of the western powers. This has compounded the effects of corruption on the continent as these western countries allow corrupt individuals to launder their stolen proceeds while turning a blind eye to the terrible effects of corruption in African societies.

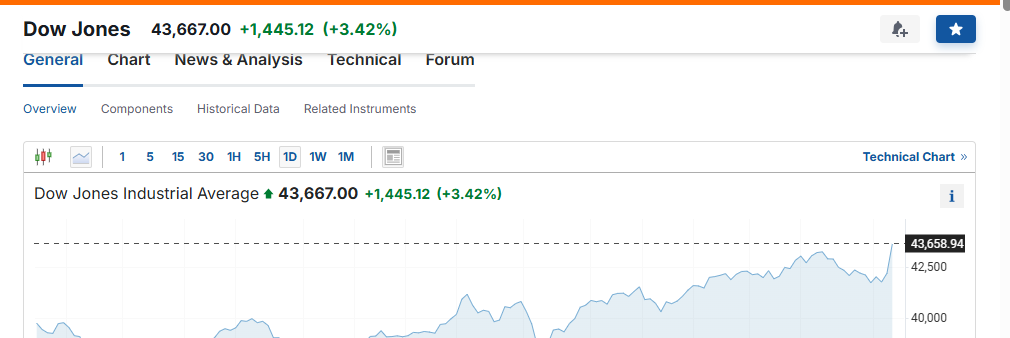

A study commissioned by the Dutch finance ministry estimates the amount of money laundered in the Netherlands at euro 18.5 billion and that money laundering accounted for approximately five percent of Dutch GDP. Of this amount, it is estimated that euro 17.7 billion emanates from crimes committed abroad through laundering in real estate investments, export under-invoicing and import over pricing and the use of ‘special purpose’ entities.

Corrupt African rulers have in the past banked their loot in Switzerland and other financial institutions in Europe. Swiss banks have in recent years returned money looted by former Nigerian rulers to the West African country after intense pressure while the UK is still to return money looted by former military strong man Sani Abacha.

Critics say western countries are the main culprits when it comes to corruption and continue to harbor the stolen loot worsening poverty among the poor in Africa. Some analysts estimate that Africa has lost US$140 billion through corruption in the decades after independence. This money was spirited away by some corrupt leaders and the close friends. Billions of dollars looted by Mobutu Sese Seko of the then Zaire are still stashed in western banks while the Congolese people continue to live under miserable conditions. Despite Mobutu’s corrupt 30-year rule, he continued to receive US and World Bank support.

DRC today is burdened by a debt of more than US$16 billion in foreign debt much of it the legacy of the Mobutu regime. In 1997, Switzerland froze Mobutu’s US$2 million villa and other assets which were estimated to total US$4 billion. Abacha stashed away US$1 billion in Swiss banks and much more remains unaccounted for in UK banks and others in Europe.

In Zimbabwe massive fraud in the banking sector facilitated by poor regulations and weak monitoring led to some bank executives speculating with depositors’ funds to acquire foreign currency to establish business concerns outside the country or to procure high value commodities abroad for importation and re-sale in Zimbabwe. A number of these bank executives fled the country following the unearthing of the scandals and running businesses in South Africa, Botswana, UK and the US using ill-gotten money.

Tsiko is The Black Star News’ Southern Africa correspondent based in Harare.

To subscribe to New York’s favorite Pan-African weekly investigative newspaper please click on “subscribe” on the homepage or call (212) 481-7745. For advertisements or to send us a news tip contact [email protected] “Speaking Truth To Empower,” is our motto.