[COVID-19\Financial Crisis]

Last week, the FDIC Inspector General issued a new report warning about multiple weaknesses in FDIC’s crisis readiness policies, procedures, and training, raising questions about whether the agency is prepared for the potential financial consequences from the coronavirus crisis.

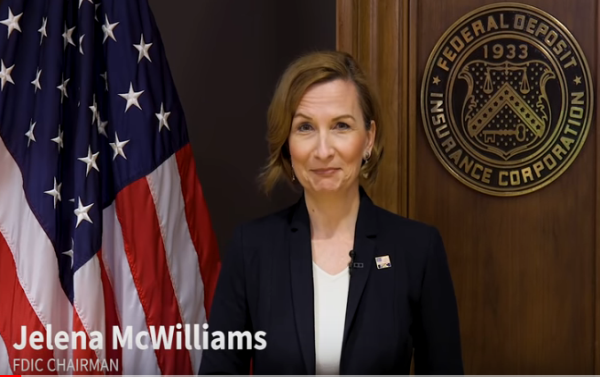

Photo: YouTube

FDIC Chairwoman Jelena McWilliams has been sent a letter questioning the agency’s readiness for a financial crisis during the COVID-19 pandemic.

Congresswoman Maxine Waters (D-CA), Chairwoman of the House Financial Services Committee, Congresswoman Carolyn B. Maloney (D-NY), Chairwoman of the Committee on Oversight and Reform, and Congressman Raja Krishnamoorthi (D-IL), Chairman of the Oversight Subcommittee on Economic and Consumer Policy, sent a letter to the Federal Deposit Insurance Corporation (FDIC) seeking information on the agency’s preparedness for a financial crisis as coronavirus poses a threat to the stability of the nation’s economy.

Last week, the FDIC Inspector General issued a new report warning about multiple weaknesses in FDIC’s crisis readiness policies, procedures, and training, raising questions about whether the agency is prepared for the potential financial consequences from the coronavirus crisis.

The Inspector General found that the FDIC lacks documented policies and procedures for readiness planning, including policies that define readiness authorities, roles, and responsibilities.

The Inspector General made 11 recommendations to improve the FDIC’s crisis readiness planning.

“In light of the ongoing coronavirus pandemic and resulting strains on the global financial system, we urge you to act immediately to establish robust crisis readiness,” the Chairs wrote.

The Inspector General has raised concerns about crisis readiness at FDIC repeatedly. In fact, Inspector General assessments identified it as a top challenge for the agency for 2018, 2019, and 2020.

“We also request that FDIC provide our staffs with a bipartisan briefing regarding steps it is currently taking to improve crisis readiness, implement the Inspector General’s recommendations, and prepare for the potential impact of the coronavirus crisis on FDIC’s critical role in maintaining the stability of the nation’s financial system,” the Chairs wrote.

Here is a copy of the letter to the FDIC:

Dear Chairman McWilliams:

We write today to request information regarding steps the Federal Deposit Insurance Corporation (FDIC) is taking to ensure that the agency is ready for a financial crisis, particularly since we are in the midst of a deadly coronavirus pandemic that is taking thousands of lives and straining our nation’s economy.

Last week, the FDIC Inspector General issued a new report warning about multiple weaknesses in FDIC’s crisis readiness policies, procedures, and training, raising questions about whether the agency is prepared for the potential financial consequences from the coronavirus crisis. The Inspector General finds that the FDIC lacks documented policies and procedures for readiness planning, including policies that define readiness authorities, roles, and responsibilities. The report also notes that the FDIC lacks an agency-wide all-hazards readiness plan and does not have a documented process for monitoring lessons learned from exercises and reviews of the prior financial crisis. The Inspector General made 11 recommendations to improve the FDIC’s crisis readiness planning.

The Inspector General has raised concerns about crisis readiness at FDIC repeatedly. For example, in February of this year, the Inspector General warned that “Ensuring the FDIC’s Readiness for Crises” is a top management and performance challenge for the agency. Citing the World Economic Forum, the February report identified five categories of risk to the world economy that also impact the banking sector, including “societal risks, such as infectious disease pandemics.”

According to the February report, the FDIC identified two critical lessons learned following the 2008-2013 financial crisis: (1) the importance of crisis readiness planning; and (2) quickly addressing emerging supervisory risks.

The February report concluded: The health of banks and the banking system depends upon the FDIC’s and other regulators’ early identification and mitigation of safety and soundness risk and the FDIC’s ability to respond to banking crises. Establishing a robust readiness framework ensures the FDIC has the organizational processes, individuals, resources, and integration necessary to respond to a crisis.

Inspector General assessments from 2018 and 2019 similarly identified crisis readiness as a top challenge for the agency.

In light of the ongoing coronavirus pandemic and resulting strains on the global financial system, we urge you to act immediately to establish robust crisis readiness. We also request that FDIC provide our staffs with a bipartisan briefing regarding steps it is currently taking to improve crisis readiness, implement the Inspector General’s recommendations, and prepare for the potential impact of the coronavirus crisis on FDIC’s critical role in maintaining the stability of the nation’s financial system.

The Committee on Oversight and Reform is the principal oversight committee of the House of Representatives and has broad authority to investigate “any matter” at “any time” under House Rule X. The Committee on Financial Services, pursuant to House Rule X, has primary legislative and oversight jurisdiction over “[b]anks and banking, including deposit insurance.”

If you have any questions regarding this request, please contact Oversight Committee staff at (202) 225-5051.