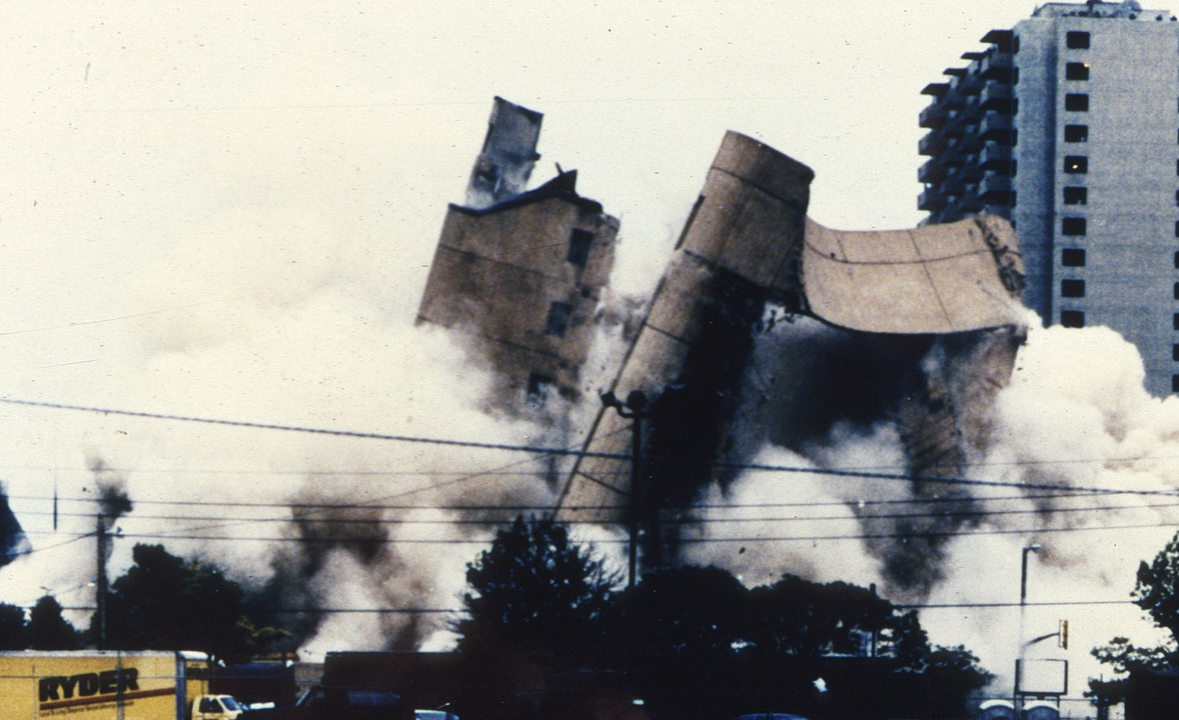

Photos: Twitter\HUD

Like healthcare and education, should housing be a human right?

In days gone by, it was traditional for the village/town/community to gather to assist a new couple in constructing their first home. The process entailed “free” labor and “free” material resources.

Today, many families cannot afford housing. Consequently, government steps in and provides a housing social benefit. As you might expect in a capitalist-like and rent seeking society, government provision of housing for the poor favors investors, who finance housing construction, and government pays to permit the poor to lodge in that housing.

But let us spin this paradigm on its head, consider a counterfactual, and ask: Given persistent poverty in a US economy where poor families require housing, would it be economically (cost) efficient for government to construct housing and provide it without charge to families in poverty?1 If healthcare for the poor is extended nearly free of charge through Medicaid, why not free housing?2

To answer these questions, we performed a simple statistical analysis. First, we obtained statistics on Federal and State and Local government expenditures on housing for the period 1963-2020 from the Bureau of Economic Analysis.3 Second, we adopted a judgmental and somewhat overstated new home construction price; i.e., 95 percent of the median price of new single-family homes sold from the Census Bureau.4,5 Dividing the first by the second we obtained the number of new housing units that could have been constructed each year. Given the typical lifespan of a new home (60-to-80 years), we cumulated the stock of these newly built homes over the period and compared the cumulated number of homes with the number of families in poverty—also obtained from the Census Bureau.6

This simple statistical analysis revealed that, starting in 1963, government could have constructed a housing stock sufficient to accommodate all families in poverty (7.5 million) by 1995—assuming that there is a significant amount (we judgmentally selected 80 percent) of persistence in the poverty spells experienced by families in poverty. Having built that housing stock, we estimate that all government housing expenditures made between 1996 and 2020 would not have been required to meet actual housing demand from poor families.

Of course, this quite simple analysis does not address a wide range of questions:

(1) How would government have financed the extra spending on housing for the poor while financing the construction of the housing stock for poor families? (2) How would homeownership have affected the wellbeing of poor families? (3) How would poor families have paid property taxes and financed required repairs to their homes? (4) How would investors have responded to government constructing new housing, which would have reduced opportunities for investments in the residential real estate rental market? (5) What would have been the impact of such a housing program on the nation’s cost of housing and on inflation broadly? (6) What would have been the best method for conducting this housing program—e.g., outsourcing, or own account construction? (7) How many jobs would have been created by the program—including for poor families? (8) What would have been the impact of the housing program on the business cycle? (9) What would have been the optimal geographical distribution for such new housing to preclude likely negative effects of poor family agglomeration? (10) Should such a free housing program also have been extended to relatively poor families above the poverty line?

The bottom line of our simplistic analysis was that, from 1996-2020, Federal, State and Local governments could have saved over USD 300 billion by constructing free housing for the poor as opposed to mainly paying investors to construct and provide rental housing.7 This saving comprised over 25 percent of the USD 1.2 trillion that was expended on housing during the period.

This cursory analysis highlights another example of government working to benefit the wealthy (in this case, mainly construction firms and real estate investors) at the expense of the poor. Going forward, it is apparent that government—including the government of a future Black American nation—should consider this alternative paradigm for providing housing for families in poverty.

By Brooks Robinson\BlackEconomics.org

References\Addendum:

1. Of course, we have avoided the question: Why are there poor families? If government functioned effectively in its provision of goods and services and guaranteed living wages (to include wages sufficient to purchase housing), then this entire analysis would be irrelevant.

2. It is common knowledge that US income tax policies extend significant support to those who can afford to participate in homeownership.

3. See line 26 of National Income and Product Account Table 3.15.5 from the Bureau of Economic Analysis; www.bea.gov.

4. See “Median and Average Sales Prices of Houses Sold” from the Census Bureau; New Residential Sales > Historical Data (census.gov).

5. Even the 95 percent of the median sales price of new homes sold is an overstated price if one agrees that not all housing needs for poor families must be met with single family homes. In other words, multifamily housing could meet a portion of housing demand.

6. See Table 4.—Poverty Status of Families by Type of Family from the Census Bureau; Historical Poverty Tables: People and Families – 1959 to 2020 (census.gov).

7. Note that government finances the development and maintenance of certain public housing units, which are utilized by a subset of poor persons under rental agreements.