[Banking\FDIC]

Rep. Nydia M. Velázquez: “Simply put, the Trump Administration is letting banks off the hook and diluting a program that is vital to preventing racist discrimination in the financial services sector.”

Photo:

NY Rep. Valasquez spoke out today about the FDIC’s vote which would likely lead to negative consequences for Black and Latino communities.

Rep. Nydia M. Velázquez commented on the Federal Deposit Insurance Corporation (FDIC) Board’s vote on proposed regulatory reforms to the Community Reinvestment Act (CRA):

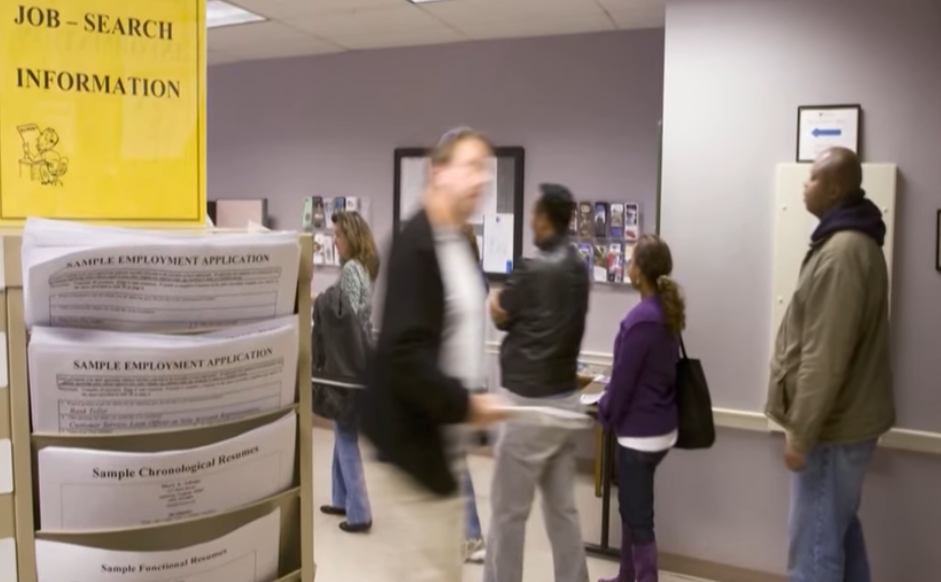

“The Community Reinvestment Act is an important regulatory bulwark that helps prevent redlining and other discrimination in the U.S. banking system. The FDIC’s vote to adopt the Office of the Comptroller of the Currency’s proposal which will likely limit lending, investing and the availability of financial services in low- and moderate-income and underserved communities.

“Simply put, the Trump Administration is letting banks off the hook and diluting a program that is vital to preventing racist discrimination in the financial services sector. Should this proposal be implemented, I will explore all available options with my colleagues on the Financial Services Committee to remedy the impact.

“We cannot reverse the progress we’ve made and go back to the bad old days when people of color and underserved communities were consistently denied economic opportunity and access to credit, due to racism in the banking industry.”

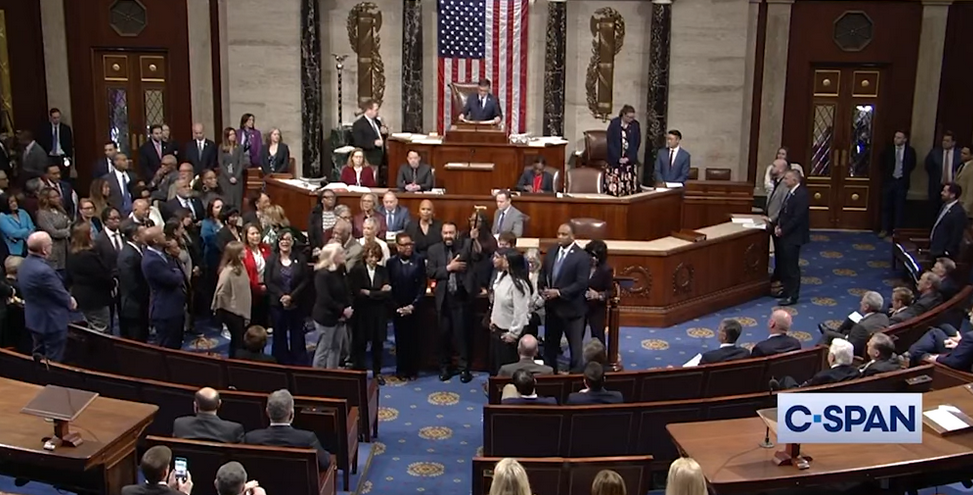

Yesterday, California Congresswoman Maxine Waters (D-CA), Chairwoman of the House Financial Services Committee, lead a delegation of the Committee in attending a public meeting of the Federal Deposit Insurance Corporation’s (FDIC) Board of Directors, which consists of FDIC Chairman Jelena McWilliams, Comptroller of the Currency Joseph Otting, Consumer Financial Protection Bureau Director Kathy Kraninger, and FDIC Board Member Martin Gruenberg.

Rep. Waters stated, “We are concerned that the changes that the FDIC and OCC are considering to modify how the CRA is implemented will make it easier for banks to pass their CRA exams, weakening their obligation to responsibly serve communities across the country. It is critical that the banking regulators do not jam through their proposal without giving the public ample time to weigh in, or without coordinating with the Federal Reserve. “And so, with our visit to the FDIC today, the Members of the Committee are continuing to conduct oversight over financial regulators. The Board should understand that we are very carefully monitoring their activities.”

The Members’ trip to the FDIC follows a letter sent to banking regulators yesterday led by Chairwoman Waters and Consumer Protection and Financial Institutions Subcommittee Chairman Gregory Meeks (D-NY) and signed by all 34 Committee Democrats, along with all 12 Senate Banking Committee Democrats led by Ranking Member Sherrod Brown. The letter, addressed to FDIC Chairman Jelena McWilliams, Federal Reserve Chairman Jerome Powell, and OCC Comptroller Joseph Otting, calls on the regulators to, at a minimum, include a public comment period of at least 120 days for any proposal reforming CRA to ensure it gets a full vetting and that all interested parties have an opportunity to analyze and comment on the proposal.

Since 2017, the Trump Administration has made financial deregulation a top priority, with the President vowing in his first few days to do a “big number” on the Dodd-Frank Wall Street Reform and Consumer Protection Act’s safeguards that Democrats put in place following the global financial crisis a decade ago.