[Education News\Student Debt]

Seth Frotman, Executive Director of the Student Borrower Protection Center: “This is a devastating indictment of the toll student debt is having on communities of color across the nation. I commend Senator Booker for his tireless work to protect borrowers and for his recognition that the student debt crisis is a critical civil rights issue. It is outrageous that the CFPB, which is charged with protecting borrowers from discrimination, has rolled back its critical oversight work of the student loan industry.”

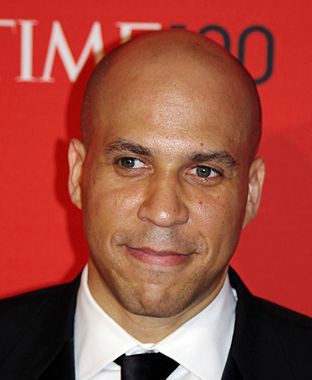

Photo: Wikimedia Commons

The Federal Reserve of New York, in response to a request by U.S. Senator Cory Booker (D-NJ), released new data demonstrating the stark racial disparities among student loan borrowers.

The data is part of a report from the New York Fed released yesterday by Booker’s office. The eight-page report found major gaps between the percentage of borrowers in default in majority-White zip codes and majority-minority zip codes in the country’s ten most segregated metropolitan areas, underscoring the lackluster enforcement efforts by the Consumer Finance Protection Bureau, the federal government entity responsible for protecting student loan borrowers. Booker formally requested the information in a letter in June to the Fed’s President and CEO.

The data indicate that across the country, majority-minority neighborhoods have staggeringly higher rates of student loan defaults than majority-white neighborhoods. In Milwaukee, for example, the rate of student loan borrowers in default in majority-minority neighborhoods nearly quadruples the rate of those in majority-white neighborhoods. Locations across the country – from Newark to St. Louis to Los Angeles – display the same reality. The data provide clear proof that, for the 44 million Americans with student loan debt totaling nearly $1.5 trillion, the student loan system is failing borrowers of color most severely.

“The racial disparities that exist among student loan borrowers are yet another example of our country’s failure to equitably provide opportunity,” Sen. Booker said. “This data demonstrates how students of color are bearing the brunt of this crisis and how we must do more to protect borrowers. It also underscores the urgency of addressing these racial disparities as the Senate moves to reauthorize the Higher Education Act. Americans should be able to afford higher education without signing on to a lifetime of debt and financial stress.”

“This is a devastating indictment of the toll student debt is having on communities of color across the nation,” Seth Frotman, Executive Director of the Student Borrower Protection Center and Former Assistant Director and Ombudsman at the Consumer Financial Protection Bureau, said. “I commend Senator Booker for his tireless work to protect borrowers and for his recognition that the student debt crisis is a critical civil rights issue. It is outrageous that the CFPB, which is charged with protecting borrowers from discrimination, has rolled back its critical oversight work of the student loan industry. This data further demonstrates the critical need for the Bureau to do its job on behalf of borrowers.”

Along with calls from the Student Borrower Protection Center and a host of civil rights groups, this data for action from the Consumer Finance Protection Bureau, highlights the need for the federal government to do more to protect borrowers.

Booker has been a forceful advocate for easing the financial burden students face when obtaining a college degree, especially low-income students and students of color. Earlier this year, Booker met with key leaders to discuss obstacles in the student loan system and practical steps that can be taken to help students, particularly low-income students and students of color. In the Senate, he has introduced and supported a number of bills to expand the affordability and accessibility of a college degree, including bills to simplify the FAFSA form, strengthen consumer protections around TEACH Grant recipients, make it easier to refinance student loans, and make college debt-free.

Booker has also pressed the Department of Education to better protect students defrauded by predatory colleges and resolve the large backlog of student loan forgiveness requests.