Photos: YouTube Screenshots

Nigeria has agreed to allow US oil giant Exxon to complete a $1.28 billion sale of some of its onshore assets in the country. But the regulator has declined to approve a similar move by Shell to sell onshore and shallow water assets as part of a $2.4 billion package.

Exxon’s transaction with Seplat had been awaiting approval since February 2022. Seplat, a Nigerian company listed on the London Stock Exchange, expects the assets to triple its oil output to 130,000 barrels per day, says the Financial Times.

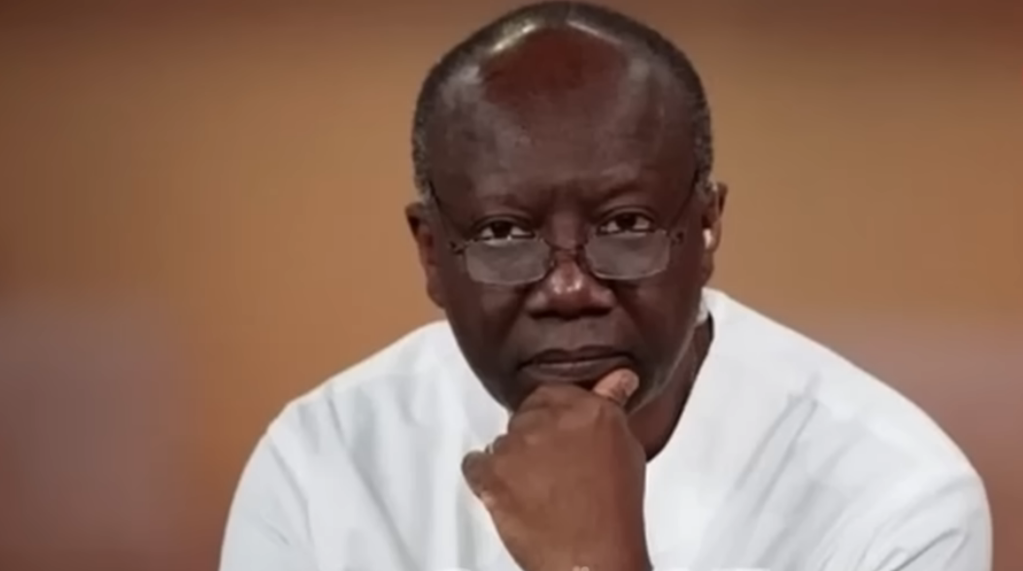

But Shell’s plan to sell assets to Renaissance Africa Energy — a group of four Nigerian companies and one foreign partner — did “not scale regulatory test,” said Gbenga Komolafe, chief executive of Nigerian Upstream Petroleum Regulatory Commission.

The scramble to sell valuable oil assets in Nigeria underscores the challenges of theft and sabotage being experienced in the sector — challenges that have undercut Nigeria’s oil production volumes and foreign exchange earnings. However, regulators and other stakeholders have appeared cautious to grant these wishes. Among the key considerations are the potential buyers’ capacity to maintain operations and concerns about alleged liability for unresolved environmental impact.

Shell’s intent to divest from assets in the Niger Delta region has faced opposition from local activists and advocacy groups like Amnesty International. Earlier this year, a report by a Dutch non-profit asked Nigeria to prevent the sale until the company takes “responsibility for its toxic legacy of pollution and ensures the safe decommissioning of abandoned oil infrastructure.”

— Alexander Onukwue in Lagos