Michael Grant shown at an event for mobilizing community development resources through the Black church, with U.S. Black Chambers Inc. President Ron Busby and A.M.E. board member Rev. Jonathan Weaver

[Op-ed: Business]

Wealth offers security and privilege that can last for generations. For minority households striving to achieve the American Dream, homeownership is often the surest path. Yet, in today’s environment and more than 50 years since the passing of the Civil Rights Act, the United States continues to experience a widening racial gap in home ownership.

Current policies are making homeownership for millions of creditworthy people of color unnecessarily difficult. More than ever, the U.S. needs a more modern approach to determining creditworthiness. It’s a relatively simple solution to a destructive divide among our nation’s households.

Homeownership and small business development were becoming the new norm in communities of color. That halted in 2008 when the Great Recession, created by an avoidable subprime crisis, hit the urban communities. Since the Great Recession, the racial wealth gap only widened during the economic recovery: non-minority households were better positioned to recover their losses through stocks and other assets, leaving people of color, who often hold much of their wealth in home equity, to face a slow and painful recovery.

We’ve seen this notably in communities like Prince George’s County in Maryland, once seen as a symbol of the African-American middle class. Today, it is experiencing some of the highest foreclosure rates in the country. Cities with high African-American and Hispanic populations, like Hartford, CT and Newark, NJ, reported in 2014 the highest number of homeowners stuck in loans far more than their homes are worth. Lending to African Americans and Latinos in 2012 was down by more than 50 and 45 percent, respectively, relative to where it stood prior to the subprime crisis.

While housing inequity has been problematic for decades, many policy makers are largely unaware of the direct link that credit scores have on housing opportunities. The nation’s government-sponsored enterprises (GSEs), Fannie Mae and Freddie Mac, rely on outdated credit scoring models from FICO in making mortgage lending decisions. These FICO models, which are now generations old, monopolize the market and lenders are left without a choice of scoring models when originating loans to be sold to the GSEs.

With credit scores being a determining factor in obtaining a mortgage, this action by the GSEs needlessly locks out of the housing market millions of creditworthy consumers, especially low income families and people of color.

We need a challenge to the outdated credit scoring models locked-in by the GSEs. My suggestion is a clarion call for alternative credit scoring models that will bring between some 30-35 million Americans into the discussions of who should and should not be worthy to receive mortgage loans in this country. By using larger swaths of data to build models and by taking into consideration alternative payments such rent, utilities, cell phones and cable, newer, more inclusive credit scoring models, like the Vantage Score model, can more accurately report credit behavior for larger numbers of consumers.

Revising the GSE guidelines can give lenders the flexibility to choose between validated models that best fit their businesses and customers. If these newer models were adopted, it could open the door for people of color seeking responsible and sustainable mortgage credit without loosening standards. According to some estimates, more inclusive credit scoring models could also expand annual purchase mortgage lending to people of color by 32% over 2013 levels. The additional revenue from new home purchases could spur the housing ecosystem, the broader economy and foster healthy competition and innovation among credit scoring models.

The imperative to improve access to mortgage credit safely and soundly in order to fix the widening wealth and homeownership gap cannot be overstated. Just as Congress, overtime, saw the competitive value inherent in having two competing mortgage GSEs, so too, it seems clear that competition in permissible credit scores that can be used to underwrite mortgages to be sold to the GSEs cannot harm and can only benefit lenders, borrowers, investors and the American economy as a whole.

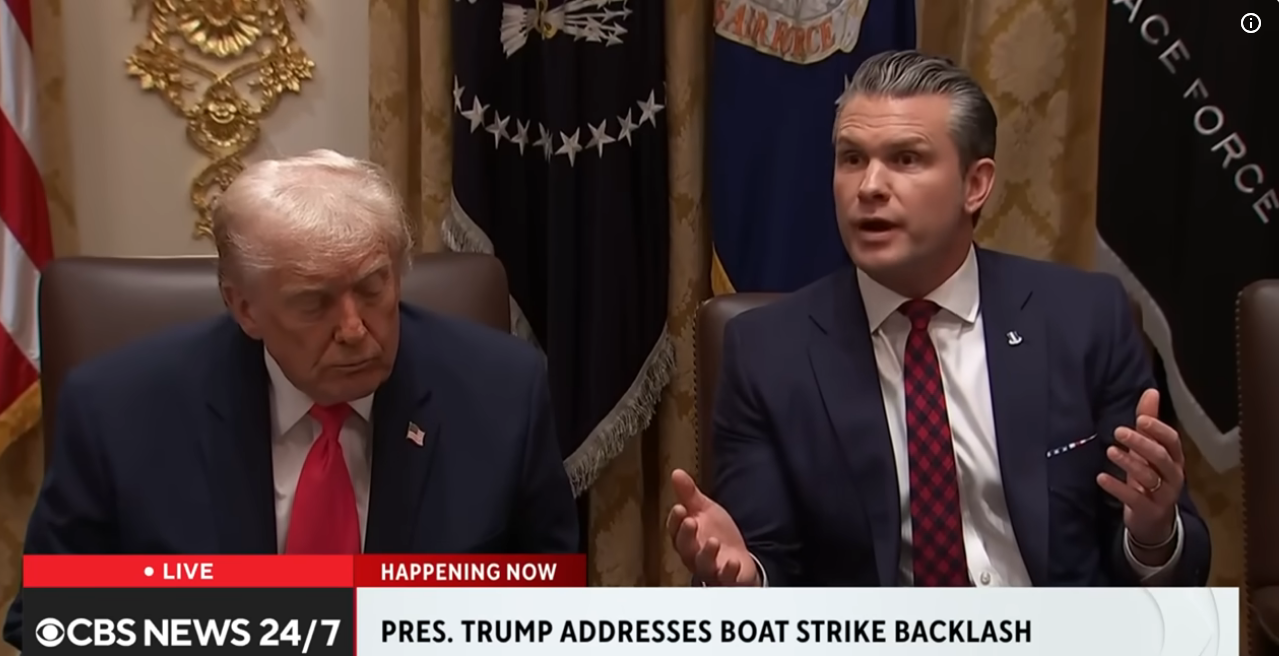

Federal Housing Finance Agency Director Mel Watt has urged the GSEs to consider this effort this year but that’s only the beginning. It’s an issue that should be squarely placed in front of President Obama, HUD Secretary Julian Castro, key legislators and industry influencers in Washington D.C. if it is to be taken seriously. To be sure, waiting until the next Administration is not an option. The time to act is now.

Michael Grant is President of the National Bankers Association, the most recognized trade association for the nation’s 177 minority and women-owned banks (MWOBs). Grant can be reached at [email protected]