Recommended Posts

-

From The Ghetto To The Republic: Bobi Wine And The Irreversible Awakening Of A Nation

By Black Star | Jan 9, 2026

-

Renee Nicole Good: Trump’s Authoritarian Regime Murders Mother Of Three

By Black Star | Jan 9, 2026

-

Legal Defense Fund Condemns ICE Agent’s Killing Of Legal Observer In Minnesota

By Black Star | Jan 8, 2026

-

“Outlaw Administration”: The United States Is An International Lawbreaker

By MEL GURTOV | Jan 7, 2026

-

Venezuela Won’t Be The End. You’re Naive If You Think So

By Black Star | Jan 6, 2026

-

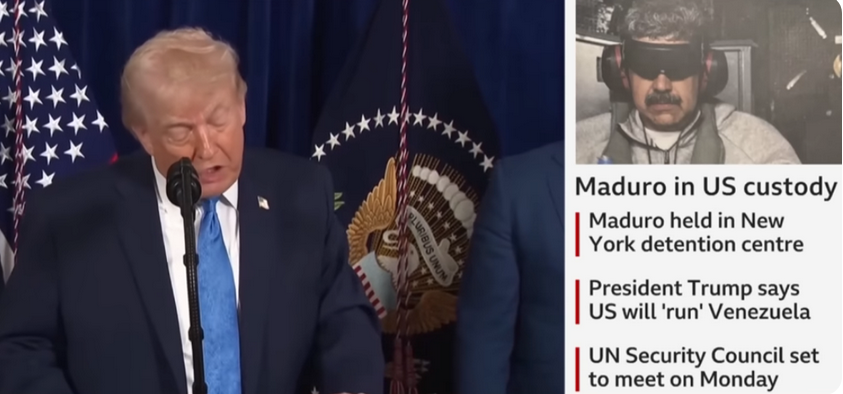

A Leader Captured, A Nation Confronted, A World Exposed

By Dr Theogene Rudasingwa | Jan 5, 2026

-

U.S. Regime Change In Venezuela Continues Long History Of Intervention In Latin America

By MEL GURTOV | Jan 4, 2026

-

U.S. Forces Kidnap Venezuelan President Nicolás Maduro In Midnight Operation

By Black Star | Jan 3, 2026