Photos: Ashmeen Modikhan

(Above homeowner Ashmeen Modikhan at the entrance of her Magnolia Court home. She could become homeless if her property is auctioned in what she calls a “fraudulent” and “illegal” foreclosure case.)

In new papers filed June 2, 2023, Ashmeen Modikhan, the Queens resident who claims the courts have turned a blind eye for over a decade as several entities schemed to fleece her, “steal” her properties—and more recently her $5 million personal injury lawsuit—argues that the case against her should be tossed out since the court lacks jurisdiction because the plaintiff did not hold the note and mortgage and therefore was not entitled to initiate foreclosure in 2010.

Modikhan’s ordeal started on Jan. 6, 2010, when attorneys with Rosicki, Rosicki & Associates, initiated foreclosure proceedings on her property which is in the Howard Beach section of Queens, New York, for BAC Home Loans Servicing LP/Countrywide Home Loans Servicing LP even though the company wasn’t the holder of her promissory note.

Modikhan has maintained all along that judges in both New York State Supreme Court, Queens county, and in the Bankruptcy Court, Eastern District of New York, have allowed purported creditors’ attorneys to file fraudulent assignments of mortgages, proofs of claim and, in one episode exposed in a Black Star News article, a forged retainer agreement, to advance what she claims are “illegal” foreclosure on her properties.

Modikhan claims she’s victim of the kind of abusive foreclosure practices that were supposed to have been resolved by the 2012 National Mortgage Settlement between the U.S. and state attorneys general on one side, and the largest banks involved in the mortgage industry, on the other.

Communities of color were the most adversely impacted by the abusive practices that cost tens of thousands of families their homes.

Modikhan’s original lender was Countrywide Home Loans Inc., which went out of business in 2008 and was acquired by Bank of America.

In the 2010 foreclosure action the plaintiff was represented by Rosicki, Rosicki & Associates. A former Rosicki, Rosicki lawyer, Courtney Williams, later joined the Gross Polowy firm which then continued the foreclosure action. (In 2018, Rosicki, Rosicki paid $4 million to settle a federal civil lawsuit “over allegations it bilked the federally sponsored mortgage banker Fannie Mae by falsely inflating bills to the mortgage servicing companies for which it worked.”)

In her new court filing, Modikhan argues that there never was an assignment of her promissory note and mortgage from her original lender Countrywide Home Loans Inc. to the 2010 plaintiff, BAC Home Loans Servicing LP/Countrywide Home Loans Servicing LP, meaning it was not the holder and had no standing—to initiate the foreclosure. A plaintiff must be the holder, as required by law, prior to the date of initiating foreclosure.

“The assignee must introduce the evidence that it obtained holder status prior to initiating the foreclosure action and clearly state how it suffered an injury; and indicate the amount paid,” the Modikhan filing states, asserting that the plaintiff lacked Article III constitutional standing to initiate the foreclosure. “The purchase of the note had to be prior to the note and mortgage being dishonored, prior to the company being insolvent and prior to the note being charged off.”

Modikhan’s debts—on both her properties; the second one is her home, at Magnolia Court—were discharged in October 2012 in the Eastern District Court.

“According to Article III of the US Constitution, any person filing a civil action must provide physical evidence demonstrating a concrete injury prior to initiating the action or foreclosure. In compliance with Article III, New York foreclosure law requires a party seeking to foreclose or initiating a civil action to submit evidence of the injury suffered before commencing the foreclosure or civil action,” the filing adds, citing a 2011 case, Deutsche Bank National Trust Company v. Barnett.

“This requirement entails presenting a certified true copy of the assignment of the promissory note and mortgage from lender, Countrywide Home Loans Inc. (CHL),” Modikhan’s papers add. “Additionally, the lender/servicer failed to present a certified true copy of the negotiated and endorsed note from the seller/original lender (CHL) nor did they provide an authenticating affidavit from the seller (CHL) indicating that (CHL) transferred and delivered Ms. Ashmeen Modikhan’s promissory note to anyone…New York Law requires that this evidence be presented at the time the foreclosure is initiate. New York Uniform Commercial Code (UCC) governs these rules.”

The issue of assignment of notes and mortgages—from the original holder and through each and every successive stage, are foundational and taken seriously by the courts.

“Furthermore, if there are multiple conveyances assignments of the promissory note from sellers who allege they have holder status in the chain of title, the note must display an endorsed signature from each alleged party who obtained holder status according to UCC 3-203, authenticating affidavits from each endorser, whether the endorsement is special (payable directly to the buyer/assignee) or in blank, must accompany by a note endorsed in blank,” Modikhan’s filing adds. “Moreover, the Plaintiff had to submit a certified true copy of Ms. Modikhan promissory note displaying each of the endorsement in the purported transfers of Ms. Modikhan’s promissory note in the chain of endorsements. The transfers and delivery of the note must be supported by each authenticating affidavit, indicating the source of their authority/power of attorney and the source of personal knowledge of each of the signatories who purported to assign or transfer rights to Ms. Modikhan promissory note in the chain of conveyances.”

“This court knew or should have known there was no certified, true copy of Ms. Modikhan’s promissory note introduced on January 6, 2010, with a special endorsement or endorsement in blank from CHL nor was there an assignment of Ms. Modikhan promissory note. The only thing submitted was an assignment of mortgage improperly acknowledged by the notary Azfar Siddiqui who failed to state within the purported acknowledgement he reviewed, and recorded power of attorney executed by CHL granting MERS the authority to assign/transfer the promissory note or mortgages on behalf of CHL,” Modikhan’s court filing adds.

“The Plaintiff failed to submit an authenticating affidavit from Mr. Donald Clark, who appears on the assignment as Assistant Vice President for MERS. There is no authenticating affidavit from Mr. Donald submitted with the purported assignment. The purported assignment is inadmissible as evidence and this court must strike this purported assignment.”

“The plaintiff BAC Home Loan Servicing LP/Bank of America, NA did not provide a certified true copy of the promissory note when they filed for default judgment and they filed for final judgment with the necessary endorsements on the promissory note or to a permanently fixed allonge displaying the endorsements,” the Modikhan filing adds.

“This is fatal to BAC Home Loans Servicing LP/Bank of America, NA. It is well settled law as stated above the fact [that] there was no evidence of endorsements and absence authenticating affidavits proving that each of the assignees ever took possession there was no way [for] this court to assert that either plaintiff obtained holder status to enforce Ms. Modikhan’s promissory note or mortgage,” Modikhan’s court filing states. “Let this be a notice under Color of Law any further actions taken against Ms. Modikhan in this matter without the plaintiff ever having established that they obtained holder status of Ms. Modikhan’s promissory note is a violation of Ms. Modikhan’s Constitutional rights to procedural due process and equal protection under the Color of Law and is a violation of 1983 Civil Rights Act.”

The mortgage attached to the original complaint by Rosicki, Rosicki, was “fabricated,” Modikhan argues.

“I’m asking the court to dismiss this lawsuit with prejudice since the plaintiff was not the holder and therefore the court lacked, and still lacks jurisdiction,” Modikhan said, in an interview. “I reserve my right to pursue civil action and criminal charges against all the entities that have dragged me through this nightmare for 13 years. They knew or should have known the original plaintiff never had the note. The parties have been filing fraudulent documents to push the case.”

Friedman Vartolo LLP, the law firm now representing the current plaintiff, US Bank, NA, as legal title trust for Truman 2016 SC6 Title Trust, asked Judge Phillip Hom, who is presiding over the foreclosure on Modikhan’s Howard Beach property in State court, to bar Modikhan from filing any more papers on the case. The judge granted the law firm’s motion on March 8, 2023.

On June 13, in response to Modikhan’s June 2 filing, a Friedman Vartolo attorney, Franklin K. Chiu, filed papers asking Judge Hom to sanction Modikhan for being in contempt of court. He asked the judge to grant the firm attorneys’ fees and cost. Chiu also asked the judge to deny Modikhan’s motion to vacate the previous orders.

There have been at least five different law firms representing various plaintiffs—at different stages—who at one point or the other claimed to have the right to foreclose on Modikhan’s properties.

Modikhan has for years claimed that judges in both the state court, and in the Eastern District Court, where she sought chapter 13 and then later chapter 7 bankruptcy protection, have “acted with willful blindness” and ignored the filing of fraudulent or forged documents. She claims the court failed to address her objections to the fraudulent proofs of claim filed.

For example, the U.S. Bankruptcy judge presiding over the chapter 7 proceeding, Jil Mazer-Marino, and the trustee Alan Nisselson, ignored the filing of fraudulent proofs of claim by Courtney Williams the former Rosicki, Rosicki lawyer, who by then was with the Gross Polowy firm. Black Star News has reported on that incident. Williams didn’t respond to a previous request for comment.

Modikhan outside her Howard Beach home

Judge Mazer-Marino also lifted the stay in State court on the sale of Modikhan’s two properties. Modikhan’s Howard Beach property was purchased by an attorney from the Friedman Vartolo firm in an “auction” on Oct. 14, 2022, for $250,000 court records show. The law firm didn’t respond to an e-mail message seeking comment.

Modikhan’s Magnolia Court, Queens home where she lives, is slated for June 23 “auction,” meaning she’ll be homeless in less than two weeks. “The courts are simply ignoring all the clear evidence of fraud,” Modikhan said.

Judge Mazer-Marino also approved chapter 7 trustee Nisselson’s motion to hire Frank Cassisi, an attorney who’d represented Modikhan in a $5 million personal injury lawsuit in State court; the judge allowed Nisselson to settle the lawsuit for a mere $500,000, with the court stating that it was now part of her estate.

In 2015, Modikhan, then an employee of American Airlines, sued Golden Touch Transportation of New York Inc., who operated bus services ferrying airlines’ employees from the terminal to parking lots. The previous year, the door of one of the buses operated by Golden Touch slammed prematurely and crushed Modikhan’s hand, causing permanent and career-ending injuries. Modikhan objected to the settlement but was told by Cassisi that Nisselson now controlled the lawsuit.

Naomi J. Skura, a lawyer with Lewis, Brisbois, Bisgaard & Smith LLP, the firm representing Golden Touch, didn’t respond to previous e-mail messages by Black Star News inquiring about the purported settlement.

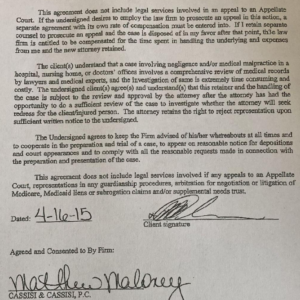

Frank Cassisi, lawyer for trustee Nisselson, filed forged retainer agreement. Photo: CassisiLaw

After Nisselson hired Cassisi, on June 22, 2022, the lawyer filed papers in the Eastern District to begin work. However, a review by Black Star News of the retainer agreement he filed—which remains on the docket—revealed that it was a forgery.

Unlike the original retainer in Modikhan’s possession, the one Cassisi filed is undated; and the signature on the agreement, attributed to Matthew Maloney, Cassisi’s former law associate, differs with that on the original.

The Cassisi version also has a section describing how finder’s fee would be paid to George Cozier, a former fellow American Airlines employee who introduced Modikhan to the lawyer, has been crossed out. In a previous article, Cassisi didn’t respond to an inquiry from Black Star News about the forgery. Alan Trust, chief judge in the Eastern District court also didn’t respond.

(In addition to the forged retainer agreement Cassisi filed in the Bankruptcy court, a review by Black Star News of several documents he filed in the State court found that at least five signatures attributed to his former associate, Maloney, don’t match each other.)

Black Star News has published four articles on Modikhan’s bankruptcy/foreclosure case prior to this one. Two of the stories were deleted from our website by unknown parties. On each occasion, this publication reported the matter to the office of New York Attorney General Letitia James. On May 16, 2023, this website was targeted in an apparent cyber-attack that incapacitated operations and resulted in the deletion of 25,768 articles.

Also in the District Court, during a hearing attended via Zoom by this reporter about Modikhan’s legal action against Darren Aronow, her former bankruptcy lawyer, Modikhan asked Judge Mazer-Marino about Cassisi’s forgery. “I won’t investigate anything. I am the judge in this matter,” Mazer-Marino said. She also added, “Because of that, I feel for me to be able to adjudicate the dispute, I don’t do the investigation.” She offered Modikhan a website address where she could report the crime.

Out of the purported $500,000 settlement proceeds from Modikhan’s lawsuit, Mazer-Marino has approved $166,666.666 as Cassisi’s legal fees. The judge authorized $1,000 per hour as fees for trustee Nisselson’s law firm Windels Marx Lane & Mittendorf, LLP. She also approved the trustee’s request that Modikhan, who had sued for $5 million, be awarded $25,000.

“So, an innocent homeowner is robbed in broad daylight within our justice system. Yet lawyers who filed forged documents in the bankruptcy court and in state court get paid. I never thought I would see this in America,” Modikhan, an immigrant from Trinidad, said.

Before Modikhan encountered Judge Mazer-Marino, she had endured chapter 13 proceedings presided over by Judge Elizabeth Stong, who ironically had handled her debt discharge in 2012. While in chapter 13, Modikhan claims she was deceived into making payments totaling $90,567.26, under the pretext that she was getting loan modification.

At the time she had an attorney, Darren Aronow, whom she claims went along with the scheme. Under the alleged scheme, Modikhan paid Aronow $1,000 per month and the chapter 13 trustee Marianne DeRosa $4,800 per month, from December 2019 to December 2020.

Then, beginning in August 2020, Modikhan started paying Rushmore Loan Services, a company who claimed it was the loan servicer, $2,950 per month.

Modikhan became suspicious about the exorbitant payments and did some online research. She eventually teamed up with a retired lawyer named Ronald O’Donnell who educates homeowners on real estate law, and a paralegal named Paris Dube. Both advised her that she was being fleeced. O’Donnell phoned and confronted Aronow, who was Modikhan’s lawyer at the time; he quit representing her.

The payments had come from Modikhan’s exempted worker’s compensation payment from her injuries at American Airlines. Modikhan demanded the return of her money.

She managed to recover $74,745. Rushmore refused to return the $8, 867.26 it received. The firm didn’t respond to a previous message seeking comment from Black Star News.

DeRosa, who has now retired, kept $5,520 of the $67,200 she received from Modikhan.

(Separately, Mazer-Marino has allowed Modikhan to sue Aronow; but she dismissed with prejudice Modikhan’s adversarial actions against the other parties including DeRosa, Rushmore, Courtney Williams. Mazer-Marino herself is presiding over Modikhan’s case against Aronow. She refused to recuse herself when Modikhan complained of a conflict of interest).

Modikhan appealed Mazer-Marino’s rulings, mentioning the fraudulent proofs of claim filed by Williams and the Cassisi forgery. Judge Eric R. Komitee, an Article III judge in the Eastern District denied Modikhan’s appeal. The judge didn’t address the issue of the Cassisi forgery and the proofs of claim.

“These judges know if they address the issue of the forged retainer filed by Cassisi, then they have to review all the other fraudulent documents I have complained about,” Modikhan said. “That would blow everything open. So instead, they are giving Cassisi a criminal pass. This is willful blindness and willful neglect.”

Modikhan has written about the matter to U.S. Attorney General Merrick Garland.

Emboldened by the bankruptcy court judges, Cassisi has asked Judge Maurice Muir, who is presiding over Modikhan’s personal injury case in State court, to replace her name as plaintiff with Nisselson’s, the chapter 7 trustee. “How can they settle for $500,000 first and then ask to change the caption?” Modikhan said. “Is this a fake settlement? Are these real courts? I want to see how Judge Muir deals with this. I want a jury trial for my personal injury case.”

Modikhan is representing herself. She said fighting the major law firms has cost her more than $200,000, wiping out her savings. She has been depending on her adult working children for living expenses. “I feel I have been targeted because I am a single Muslim woman of color,” Modikhan said. “My integrity has been challenged. I will not let anyone take my integrity.”

On several occasions she has been reduced to tears during interviews with this publication.

Modikhan hopes that her June 2 State Supreme Court filing and jurisdictional challenge will help turn things around.

“Jurisdiction is a threshold issue; it is the court’s responsibility to know the governing law for who can enforce a promissory note and mortgage, to foreclose,” Modikhan’s court papers state. “The plaintiff BAC Home Loans Servicing LP/Bank of America, NA in this case lacked standing to bring a foreclosure/civil action because it had no evidence it obtained holder status prior to initiating this case on January 6, 2010, in accordance with New York UCC controlling law for who can enforce a promissory note.”

Attorneys at the Friedman Vartolo firm didn’t respond to an e-mail message from Black Star asking if the firm was retained by U.S. Bank, NA, to pursue foreclosure on Modikhan’s properties.

The firm also didn’t respond to questions about the original plaintiff’s lawsuit, about jurisdiction, about Williams’ fraudulent proofs of claim, and about Cassisi’s forged retainer agreement.

However, in the law firm’s June 13 oppositional papers Friedman Vartolo attorney Chiu asked Judge Hom to reject Modikhan’s filing, calling it “frivolous” and “vexatious” and merely intended to delay the foreclosure.

According to Chiu, Modikhan’s “belated challenges to plaintiff’s standing, and also the court’s jurisdiction, are precluded as a matter of law.”

Black Star News submitted the same questions posed to the Friedman Vartolo firm to U.S. Bancorp, the parent company of U.S. Bank, NA. Cheryl Leamon, spokesperson, in an email message said, “I can confirm we serve as trustee in this situation…I will decline to comment further.”

An e-mail message to Judge Hom, who is presiding over foreclosure on Modikhan’s Howard Beach property, bounced back with the error indicating that Black Star News was blocked. An e-mail message with questions to Judge Hom about jurisdiction was sent via e-mail message to Justice Marguerite Grays, the Administrative Judge and copied to spokesperson for the New York State Unified Courts System Lucian Chalfen.

The $25 billion National Mortgage Settlement deal was struck in 2012 between the federal government and 49 state attorneys general with five large banks involved in wrongful foreclosure and servicing activities.

“These violations include servicers’ use of ‘robo-signed’ affidavits in foreclosure proceedings; deceptive practices in the offering of loan modifications; failures to offer non-foreclosure alternatives before foreclosing on borrowers with federally insured mortgages; and filing improper documentation in federal bankruptcy court,” the U.S. said, in a press release by the Department of Justice, at the time of the agreement.

The five banks are: Bank of America Corporation; JPMorgan Chase & Co.; Wells Fargo & Company; Citigroup Inc.; and Ally Financial Inc.

Servicers were required to implement comprehensive new mortgage loan servicing standards and to commit $25 billion to resolve violations of state and federal law.

Out of the $25 billion deal, $1 billion was to “resolve a separate investigation into fraudulent and wrongful conduct by Bank of America and various Countrywide entities related to the origination and underwriting of Federal Housing Administration (FHA)-insured mortgage loans, and systematic inflation of appraisal values concerning these loans, from Jan. 1, 2003, through April 30, 2009,” according to the statement.

“Payment of $500 million of this $1 billion will be deferred to partially fund a loan modification program for Countrywide borrowers throughout the nation who are underwater on their mortgages,” the statement read.

Modikhan said she called and wrote to Bank of America, who was now the new server, several times about the modification and got no response.

Recently, on April 26, Modikhan attended a Brooklyn meeting organized by the Consumer Financial Protection Bureau (CFPB), where State Attorney General James addressed the issue of “zombie” debts.

The CFPB also issued a guidance on debt collectors who threaten to foreclose on homes with mortgages past the statute of limitations, in violation of the Fair Debt Collection Practices Act.

Comments are closed.