Frank C. Cassisi and Frank J. Cassisi. Cassisilaw.com

By Milton G. Allimadi

If your children want to get away with filing forged documents in U.S. courts when they grow up tell them to make sure they first earn law degrees.

Americans hear or read about corruption at the highest levels of the judicial system and governments in so-called “Third World” countries.

Welcome to the U.S. judicial system; specifically, the U.S. Bankruptcy Court, Eastern District of New York and the New York State Supreme Court, Queens County, whose woes are symptomatic of a national problem affecting all areas of the law—bankruptcy, civil, criminal, surrogates, and family courts to name a few.

Here you’ll find all the dysfunctions that Americans are constantly informed are endemic to so-called “less-developed” countries. Our cases in point today are Ashmeen Modikhan’s. She’s a 60-ish grandmother. The failures of the courts system—or “success,” depending on how you look at it—in Modikhan’s cases would be breath-taking if they weren’t, unfortunately, common. We begin with clerks who accept and record fraudulent documents that don’t comply with the rules of procedure and the judges who know better but willfully turn a blind eye.

Modikhan is the victim of wrongful foreclosure that’s resulted in the wrongful sale of her two real properties—she’s fighting to recover them—and also morphed into a scheme to deprive her of her $5 million personal injury lawsuit. One of the lawyers involved in her cases, Frank J. Cassisi, has filed forged documents in both the Bankruptcy and State Courts. In Bankruptcy, Cassisi filed an undated purported retainer “agreement” with a signature that doesn’t match the one in the dated version in Modikhan’s possession. These forged documents remain on the dockets in both courts even though judges presiding over the case—as well as administrative judges—have been notified by Modikhan and by this writer. The ongoing coverup are even worse than the transgressions.

How does a victim like Modikhan defend herself? She once had money and hired lawyers. Even that didn’t help.

She burned through more than $100,000. Now she’s penurious and she represents herself against adversaries who are represented by high-powered attorneys from major law firms. She’s fighting a system that won’t abandon lawyers like Cassisi; at least not up to this point.

I’ve been exposing corporate and judicial malfeasance for decades. One of my earliest scoops was about a scheme by investment bank Morgan Stanley to entrap an African American banker who was about to sue for alleged wrongful termination based on race and perceived sexual orientation.

I revealed that the firm had paid an informant $10,000 to entrap the dismissed banker named Christian Curry into agreeing to feed racist e-mail messages targeting himself into Morgan Stanley’s computer systems. The lure of the idea was that the ugly e-mails would boost the chances of success for his prospective lawsuit against the firm.

After I reported the firm’s scheme, Curry, who’d been arrested, was released. He sued Morgan Stanley for $1.35 billion. The parties settled the case. Two senior lawyers with the firm lost their jobs due to their role in the scheme. Several outlets picked up my story. I was interviewed on CNN and for a Wall Street Journal column.

In recent years, I’ve been writing about judges who are accused of biased rulings. Modikhan—and dozens of other complainants—approached me two years ago after WNBC Channel 4 aired a segment by investigative reporter Sarah Wallace about my series of articles exposing biased rulings by Margaret McGowan and William Viscovich, two New York State Supreme Court judges, Queens County. (More people continue to complain about Judge Viscovich, including two who have reported him to the FBI; McGowan has retired).

Since last October, I’ve reported on and published a series of articles that led to the termination by U-Michigan Health-Sparrow hospital system of Dr. Paul Gregory St. Claire, an anesthesiologist who allegedly drugged his Haitian immigrant wife with antipsychotic drugs for years in order to induce psychosis and coerce her into signing a postnuptial agreement that awarded him the bulk of the couple’s marital wealth. Dr. St. Claire was also accused of sexual harassment by his co-workers and a patient.

Modikhan, of Queens, New York, ended up before Judge Mazer-Marino in the U.S. Bankruptcy Court because of two illegal foreclosure proceedings initiated in the state court on two properties in 2010 and 2012 respectively. In order to foreclose on real property, the mover is required by law to be in possession of both the mortgage and promissory note. The plaintiff must provide valid assignments of mortgage that have been recorded in the county land records that correlate to the endorsements found on the original wet-ink promissory note. Neither of these happened in Modikhan’s cases.

In fact, the case filed in 2010 was dismissed in 2014 in the State Court because the plaintiff didn’t have the promissory note. Yet, these smooth operators know how to resuscitate cases from the grave.

Typically, when the lawyers handling a foreclosure run into roadblocks or legal hurdles—if they are of the shady type—they throw a lateral-pass to another law firm which then has the advantage of being able to avoid the previous firm’s pitfalls.

In Modikhan’s case, one of the foreclosures was initiated by Rosicki, Rosicki & Associates, a law firm that was later sued by the federal government for engaging in widespread fraudulent foreclosure proceedings and fined $6 million. The Rosicki firm later later hired a lawyer named Courtney Williams. When she left Rosicki and joined the Gross Polowy firm she continued the wrongful foreclosure action against Modikhan’s properties.

Once the foreclosure cases were revived in the State Court, Modikhan hired an attorney named Darren Aronow to represent her. He promised to arrange a loan modification for her in the U.S. Bankruptcy Court.

Modikhan wasn’t aware that earlier that year, on April 29, 2019, Aronow had signed a consent order and settlement agreement with the State of Maryland for having taken upfront money from 44 homeowners and never delivering the loan modification he’d promised them, in direct violation of federal law.

Under the agreement signed by Aronow and Teresa M. Louro, Maryland’s deputy commissioner of financial regulation, Aronow was to refund $122,661.50 to the homeowners, pay a $10,000 penalty to the state, and $2,170 in an investigative fee. According to the agreement, Aronow had “advertised and marketed loan modification services” to Maryland residents, taken their money but “did not obtain a loan modification” for the homeowners. The upfront fees paid to Aronow by the individual homeowners ranged from $800 to $5,450 each, according to the settlement agreement.

Ms. Louro didn’t respond to a message seeking comment about whether Aronow fulfilled the obligations of the settlement.

Aronow’s lawyer Richard Artura also didn’t respond to an e-mail message seeking comment.

Aronow never challenged fraudulent Proofs of Claim (POC) filed by Courtney Williams of the Gross Polowy law firm on behalf of the purported secured creditors in the State Court or in the Bankruptcy Court.

For example, Williams filed a POC on Jan. 9, 2020 in the Bankruptcy Court for Tiki Series IV Trust as creditor, in the amount of $689,154.49. However, court documents show that the assignment of mortgage from a company called MTGLQ to U.S. Bank as trustee for Tiki Series IV wasn’t executed until April 28, 2020. This is more than three months after Williams’ filed the POC. Filing a fraudulent POC is punishable by five years imprisonment or a $500,000 fine; or both.

Modikhan has argued that MGTLQ isn’t a mortgage company but an investment company that bought several pools of mortgages—mortgage loans in default for pennies on the dollar. Nationstar was the servicer. The “assignment” Modikhan alleged was fabricated by Gross Polowy the attorneys for Nationstar—the plaintiff in the foreclosure. Modikhan argued that the attorneys never advised the court that Nationstar was no longer the alleged plaintiff, and the case should have been dismissed.

Still clueless about what Aronow had done in Maryland, Modikhan started making monthly payments toward what her lawyer told her was a loan modification arrangement in the Bankruptcy court.

As part of the paperwork for the purported modification—to justify the astronomical amounts Modikhan was made to pay—an Aronow associate, Hanin R. Shadood e-signed and filed a fraudulent schedule A/B on behalf of Modikhan, claiming she had a balance of $63,000 in her bank account when she actually had a mere $1,700.78. Shadood was then hired as the chapter 13 trustee Marianne DeRosa’s counsel on Feb. 2, 2020, even though she remained the attorney of record for Modikhan through March 2021.

The presiding judge was Elizabeth Stong. Under the purported loan modification plan, Modikhan paid Aronow $1,000 per month in illegitimate fees from January 2020 to November 2020; she paid the trustee Marianne DeRosa $4,800 per month over the same time-frame; and from August 2020 until October 2020, she paid Rushmore Loan Services, her purported loan servicer, $2,950 per month.

Modikhan began to suspect that something was amiss. She didn’t know much, but why was she paying more than what she’d paid in the past if modification was meant to ease her burden by lowering the interest rate and the principal amount?

After many hours of online research, Modikhan met Ronald O’Donnella real estate educator and Paris Dube, a paralegal, both of whom teach homeowners on how to detect foreclosure scams. O’Donnell picked up the phone and confronted Aronow who immediately filed a motion to be relieved as Modikhan’s counsel.

Modikhan demanded that her money be refunded. The trustee DeRosa gave back $61,700 but kept $5,500; Aronow returned $13,065; Rushmore refused to return any money.

Modikhan asked presiding judge Elizabeth Stong to recuse herself, claiming she’d been biased by recognizing entities that filed fraudulent POCs to gain standing as secured creditors.

She wrote to the Bankruptcy Court Chief Judge Trust complaining about Judge Stong. By the time Judge Stong recused herself, Modikhan had converted to chapter 7 bankruptcy protection, hoping a new judge would be assigned and she’d be protected from making the kind of payments she’d made in chapter 13. Jil Mazer-Marino became the presiding judge.

Modikhan filed an adversarial action, the equivalence of a lawsuit within the bankruptcy court, against Aronow, his associate Shadood, DeRosa, Williams, Rushmore, and other parties. Judge Mazer-Marino dismissed the action against the parties with prejudice, except for some of Modikhan’s malpractice claims

against her former lawyer Aronow. (That case is ongoing in the Bankruptcy court; the presiding judge is Mazer-Marino who has twice denied Modikhan’s motions that she recuse herself).

Judge Mazer-Marino denied Modikhan’s motion to withdraw from the chapter 7 bankruptcy proceeding. She subsequently lifted the automatic stay in the State court on the sale of Modikhan’s two properties, including the home where she lives.

The chapter 7 trustee Alan Nisselson refused Modikhan’s request that he examine the POCs filed by her adversaries that she’d alleged were fraudulent. In court papers dated July 25, 2022 objecting to Modikhan’s motion to withdraw from the chapter 7 proceedings, Nisselson wrote: “While the filed claims appeared to be valid as filed based upon a review of Debtor’s schedules, the trustee will make a more extensive review of the claims at the appropriate time.” Two years later, he’s yet to make the “more extensive review,” let alone any review.

Judge Mazer-Marino, Chief Judge Trust, and trustee Nisselson didn’t respond to an e-mail message seeking comment.

After Modikhan challenged the POCs, the Gross Polowy threw a lateral pass and the case landed in the hands of a new firm, Friedman Vartolo. A lawyer with the firm named Michael William Nardolillo bought Modikhan’s two properties at an auction that raised many questions about the documentation involved.

This brings us to Frank Cassisi’s role in this whole mess.

Judge Mazer-Marino approved trustee Nisselson’s fees of $1,000 per hour. Since the court now controlled her estate, including her personal injury lawsuit, Mazer-Marino also granted Nisselon’s motion to hire Cassisi as his counsel and to settle Modikhan’s $5 million lawsuit against Golden Touch Transportation of New York Inc., over her objection for a mere fraction— $500,000, which amounts to the insurance policy limit.

The judge also approved the payment of $166,666.666 as Cassisi’s legal fees notwithstanding the forged documents he’d filed in Bankruptcy and State Courts. The judge approved Nisselson’s request that Modikhan receive $25,000, the statutorily allowed exemption in bankruptcy, which is 0.5% of her original lawsuit amount.

Modikhan had hired Cassisi in 2015 and sued Golden Touch, a vendor for her former employer American Airlines. In 2014, the door of a bus operated by Golden Touch to ferry American Airlines employees from terminals to parking lots had shut and crushed Modikhan’s hand causing permanent, painful, debilitative injuries to her hand that also affected her arm, and back. She’s been fighting for years to take her case to jury trial.

Modikhan believes she’s being retaliated against for exposing the loan modification scheme, demanding the refund, and filing the adversarial action.

She questions why Judge Mazer-Marino is allowing the trustee to seize any potential proceeds from her personal injury lawsuit when what she calls “fictitious creditors” have already wrongfully seized her two properties—through the sales she’s still challenging—and thereby satisfied any purported “debts.”

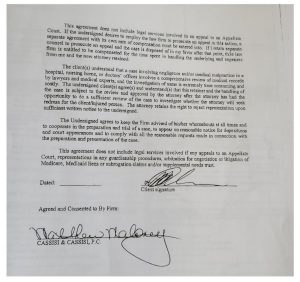

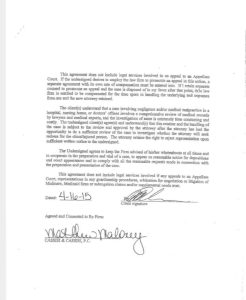

Cassisi, in preparation for work with his new client Nisselson, on June 22, 2022 filed a copy of the purported retainer agreement he’d allegedly executed with Modikhan in 2015.

Unquestionably, Cassisi filed a forged document and thereby compromised what might have been a “perfect” plan. The purported “agreement” has no date and the signature on it attributed to Cassisi’s former law associate, Mathew Maloney, doesn’t match Maloney’s signature on the version of the retainer in Modikhan’s possession. Modikhan’s version is also dated, and contains a paragraph describing how George Crozier, a former American Airlines co-worker who introduced her to Cassisi would be compensated a finder’s fee. This section is crossed out with a pen in Cassisi’s version.

During one of the many hearings Modikhan had before Judge Mazer-Marino, which I attended via Zoom, she asked the judge to report the Cassisi forgery for investigation. The judge impatiently brushed her off and offered a url address where, she said, Modikhan herself could report Cassisi. When Modikhan asked how she would react if she’d been the one who’d filed a forged document on the docket Judge Mazer-Marino said, “I wouldn’t do that if I were you.”

I wrote to Chief Judge Trust about the Cassisi forgery when I first discovered it and through a spokesperson he declined to comment. As of today, Aug. 3, 2024, the forged retainer agreement remains on the Bankruptcy court’s docket. Any member of the public or a government investigator can view it via Public Access to Court Electronic Records Pacers link and searching for case number 19-46591 and docket number 284.

Modikhan appealed Judge Mazer-Marino’s rulings, highlighting the fraudulent POCs and the Cassisi forgery. The appeal was denied by a single judge, Eric R. Komitee, who is listed on the court’s website as an Article III District Court Judge. Judge Komitee never even mentioned the Cassisi forgery.

Why is Judge Mazer-Marino, Chief Judge Trust, and Judge Komitee ignoring Cassisi’s blatant forgery in the Bankruptcy Court? Could it be that holding this lawyer accountable means the court would also have to review Modikhan’s allegations that the POCs were fraudulent, as already demonstrated in this column based on the Jan. 9, 2020 date Courtney Williams filed for Tiki Series IV Trust? Modikhan insists there are no creditors of standing and that she’s dealing with debt collectors. Judge Mazer-Marino has denied Modikhan’s motion for an evidentiary hearing that she insists would expose the fraudulent POCs.

Instead of dealing with Cassisi’s forged document and addressing Modikhan’s claims about the fraudulent POCs the court is determined to throw her under the bus.

Previously, Judge Mazer-Marino had permitted this reporter to cover the case via joining the zoom sessions like all the other parties involved.

At some point her clerk suddenly informed me that the judge said I could no longer cover the case via zoom and would have to appear in her Brooklyn courtroom—I live in the Bronx—even though everyone else participated via zoom.

It does appear that rather than dealing with Cassisi’s forgeries—which is of course a crime—Judge Mazer-Marino and Chief Judge Trust would rather toss his victim, Modikhan, under the bus.

When I discovered Cassisi’s forged retainer agreement on the Bankruptcy Court docket, I suspected this wasn’t the first time he’d engaged in this type of nefarious behavior. I decided to review the papers he’d filed in State Court on Modikhan’s behalf in the Golden Touch case.

Lo and behold, I wasn’t surprised to find several documents with signatures purporting to be Maloney’s that don’t match any of his signatures on the other papers. Some were even executed before Maloney joined Cassisi’s firm.

There’s a signature attributed to Maloney on the “Request for Judicial Intervention” filed in the State Court by Cassisi’s firm on Dec. 24, 2015 that doesn’t match his purported signature on the forged retainer agreement Cassisi filed in the U.S. Bankruptcy court. It also doesn’t match the signature on the dated version of the retainer in Modikhan’s possession.

Then there’s another purported Maloney signature on a document that’s ironically entitled “Affirmation of Good Faith,” also filed on Dec. 24, 2015. That signature doesn’t match the ones on the documents just discussed; it doesn’t even match the one on the “Request for Judicial Intervention” filed on the same day.

What’s more, Maloney’s registration for the Cassisi firm wasn’t processed until Sept. 9, 2016, according to a letter from Samuel H. Younger, the chief management analyst for the Office of Court Administration, Attorney Registration Unit. So how could he have signed the “Request For Judicial Intervention” and the “Affirmation of Good Faith,” on Dec. 24, 2015 or any purported retainer agreement with Modikhan in April 2015?

After discovering the forged documents I reached out to both Judge Maurice Muir who was presiding over the Golden Touch case as well as Chief Administrative Judge, State Supreme Court, Queens County.

The spokesperson for the New York Unified Courts system also previously didn’t respond to an e-mail message seeking comment.

Who can blame Cassisi if by now he felt he was invincible? On Sept. 2, 2022 he filed a motion before Judge Muir asking that the chapter 7 trustee Nisselson’s name replace Modikhan’s as the plaintiff in the Golden Touch case.

After postponing several court dates, on July 27, 2023 Judge Muir sent an e-mail message summoning all the relevant parties to appear in court on Aug. 24, 2023 at 11 a.m. to hear oral argument on Cassisi’s motion.

Those receiving the e-mail message included: Modikhan; Cassisi; Nisselson, the trustee; Naomi Skura—who at the time was with the Lewis Brisbois Bisgaard & Smith firm, representing Golden Touch; Timothy Tenke, who’d replaced Maloney as Cassisi’s associate; Edmund B. Troya, an attorney representing Nisselson; and Maloney himself, who by then was employed at the Simmons Jannace DeLuca firm.

Modikhan was elated. Finally all the parties would appear before the judge and the truth would be revealed, she thought.

However, the Aug. 24, 2023 court date was canceled.

On Aug. 25, 2023 Modikhan wrote to Judge Muir, urging him to refer Cassisi’s actions to law enforcement agencies. “Justice Muir I know that Bankruptcy Court is not your jurisdiction,” Modikhan’s letter read in part, “but since Mr. Cassisi also filed forged documents in State Court could you please refer him for criminal investigation by New York State Attorney General Hon. Letitia James, and Queens DA Melinda Katz and New York Police Department?”

Without ever holding the hearing he’d ordered for Aug. 24, 2023, on March 29, 2024, Judge Muir granted Cassisi’s motion to substitute Nisselson as the plaintiff. Modikhan’s name was removed from the Golden Touch Transportation case. This was another victory for the team with license to file forged papers.

On May 7, 2024, a pretrial conference was held in the State court before Judge Frederick Sampson. Facing the judge were: Modikhan; Daniel D. Wang, who’d replaced Skura as the lawyer representing Golden Touch, with Lewis Brisbois Bisgaard & Smith; and Cassisi and his new associate, his son, Frank C. Cassisi. Tenke had departed the firm.

Cassisi saw no reason why Modikhan was still appearing since she’d been replaced as the plaintiff by Nisselson. According to Modikhan at one point Cassisi blurted, “This case has already been settled.”

Whereupon, Modikhan said, Judge Sampson asked a sensible and logical question: “When was it settled? Before or after the substitution?”

Cassisi didn’t respond to the question, according to Modikhan.

Modikhan maintains that any so-called “settlement” before the substitution was illegitimate since she was still the plaintiff.

She believes that Cassisi may have settled the case years ago, even before the involvement of trustee Nisselson, and just never informed her.

She doesn’t believe it’s a coincidence that both Maloney and Tenke, the former Cassisi associates, both left his firm; she believes the case had something to do with the two lawyers parting ways with Cassisi. She also doesn’t believe it’s coincidence that Skura who’d represented Golden Touch, left the Lewis Brisbois Bisgaard & Smith firm.

On June 24, 2024 Modikhan wrote to Judge Muir seeking permission to file a motion to compel Nisselson, Cassisi, and Wang to produce all documents related to the purported settlement of the case. She also filed a notice of intention to appeal Muir’s March 29, 2024 order granting the substitution.

On July 3, 2024, Brian J. Isaac, a lawyer with the Pollack Pollack Isaac & DeCicco firm, who is representing Nisselson and Cassisi, filed a motion asking that Modikhan’s appeal, which has not yet been filed, be dismissed.

These lawyers didn’t respond to e-mail messages this week seeking comment: Cassisi; Wang; Isaac; and Courtney Williams.

These judges didn’t respond to e-mail messages this week seeking comment: Judge Grays; Judge Muir; and Judge Sampson.

Modikhan continues her solitary struggle, against these white shoe law firms, for justice and to expose the truth.

The biggest lesson so far is clear: remind your children that if they hope to one day file forged documents in the courts and avoid imprisonment, they must first earn a law degree.

Part one of a series.

If you or someone you know have had a similar experience before the courts system please contact the author via [email protected]