June 3, 2019 (GIN) – Lending institutions fear that Kenya’s foot may be stuck on the debt pedal with the latest loan in the amount of $750 million from the World Bank to be paid over 30 years.

A number of experts and players in the financial sector do not think all is well.

.

The Central Bank, which is the government’s banker, the International Monetary Fund (IMF), the Parliamentary Budget Office (PBO), the Institute of Certified Public Accountants of Kenya (ICPAK) and the Institute of Economic Affairs (IEA) all say Kenya’s debt position is getting to dangerous levels and the country must engage a lower gear before it is too late.

Financial analysts and economists have also raised concern on the speed at which Kenya is borrowing – a sign of the country’s rapidly deteriorating cash-flow situation.

The IEA, an economic think tank, recently warned that Kenya risks defaulting on its debt obligations in a decade if the current appetite for borrowing remains unchecked. The government has since defended the increased borrowing alluding to demand in investing in infrastructures such as roads and railways.

Critics have however questioned the government’s debt binge saying this is likely to lead to heavy taxation of Kenyans in order to pay debts when the demand arises.

Kenya’s debt repayments to both internal and external creditors have increased by 50 per cent over the past year with net servicing charges for both internal and external debt up by 48.2 per cent, the 2019 Edition of the Economic Survey says.

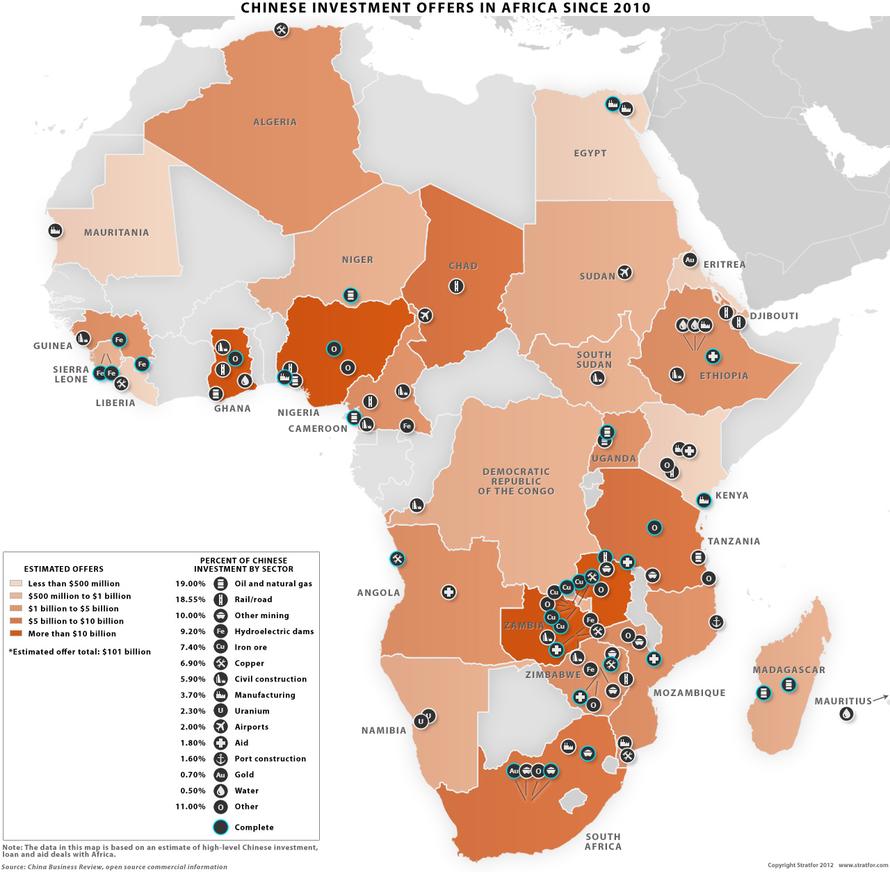

This comes even as the Government is in China to negotiate additional loans that are expected to push up the country’s debt owed to China to record levels.

China now accounts for 70 per cent of the country’s external debt, with Kenya now owing the Asian nation more than twice the amount of money Kenya owes Germany, Japan, France, USA and Belgium combined.

Kenya has borrowed heavily from China to fund a $4.8 billion railway project, the country’s largest infrastructure project since its independence from Britain in 1963.

As a result, Kenya’s debt servicing costs will consume one-third of the government’s revenues this year, according to the Nairobi-based Institute of Economic Affairs. That is one of the highest ratios in sub-Saharan Africa.