By Black Star News

Photos: YouTube Screenshots

Kenya’s foreign debt was the subject recently scrutinized in two reports by ratings agencies.

Last week, Moody’s announced that debt servicing costs in the country would remain very high because it relies “predominantly on the domestic market to meet its fiscal financing needs.”

The report says that approximately two-thirds of of Kenya’s financing is from domestic sources, which is below four percent of GDP per year. The risk of high public debt was also identified, by Fitch.

MarketForces Africa noted that “This higher level of credit risk indicates that the ratings agency believes there is a material default risk for Kenya when it comes to repaying its foreign currency debts,” also saying that “a limited margin of safety remains.”

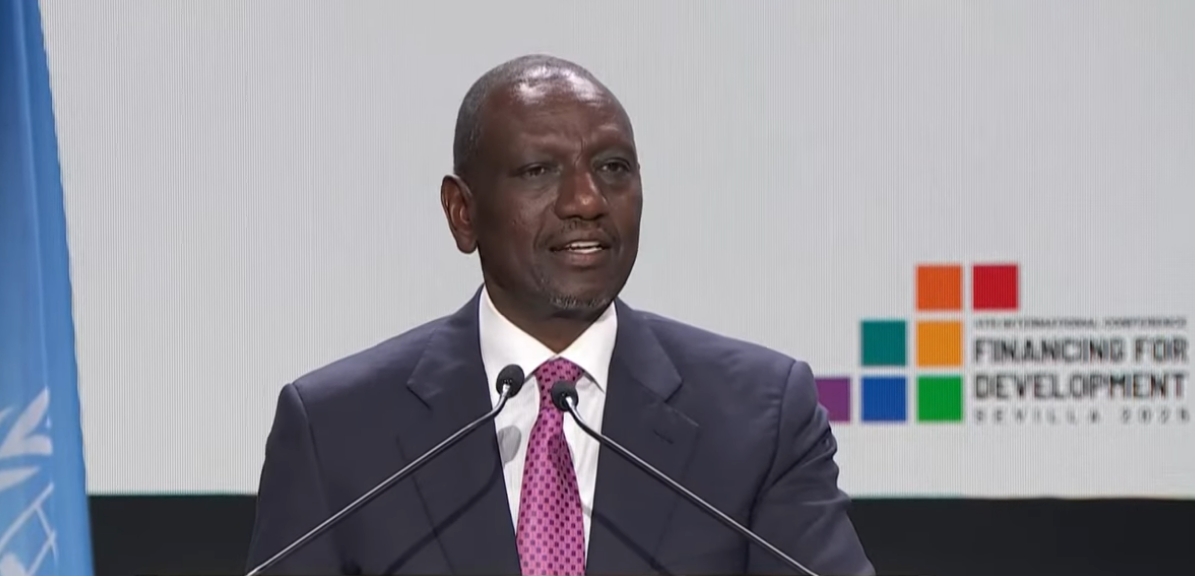

For now, Kenya has been able to steer clear from debt default. However, President William Ruto is under immense political duress as deadly protests have rocked his administration for the last few months.

To Support our independent investigative journalism contributions are welcome via Cashapp to: $BlackStarNews

Also support Black Star News by buying merch from our brand new Black Star Store!