Photo: Wikimedia Commons

Ghana’s central bank held an emergency meeting last week without announcing a decision on its key lending rate, sparking uncertainty around monetary policy ahead of the mid-year budget on Thursday.

The country is recovering from its worst economic crisis in decades.

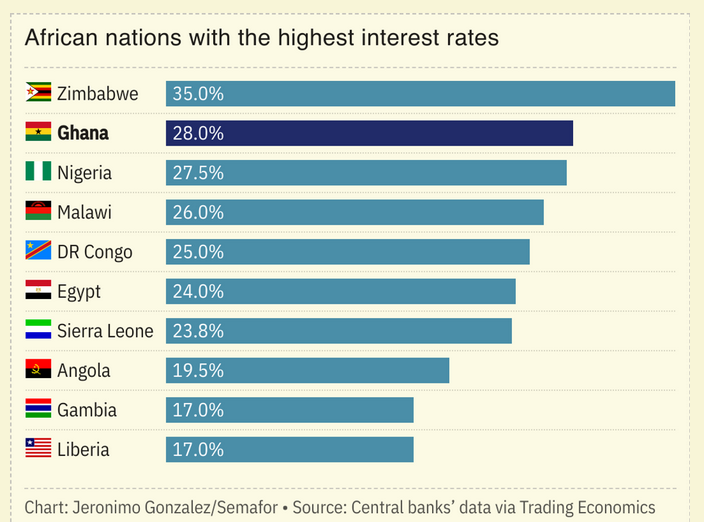

The Bank of Ghana held its benchmark lending rate at 28% at the monetary policy committee’s last scheduled meeting in May. With exchange rate stability helping inflation to slow to 13.7% in June, its lowest level since 2021, some analysts expected the bank to start easing its policy stance to reduce borrowing costs and stimulate growth.

On Thursday the bank said its rate decision would be announced on July 30, after its regular meeting.

The move comes amid questions about the economic realities faced by Ghanaian businesses, despite the cedi being one of the best performers against the dollar this year. Last week a group of importers said banks are refusing to make dollars available at the official rate, forcing them to “resort to the black market for dollars at exorbitant rates.” Central Bank Governor Johnson Asiama, responding to the claims, said the cedi’s recent gains were not “cosmetic.”

Read on for more on what Ghana’s central bank governor did and didn’t say. →

To Support our independent investigative journalism contributions are welcome via Cashapp to: $BlackStarNews

Also support Black Star News by buying merch from our brand new Black Star Store!