Tameria Mizell of Port Charlotte, Florida, wanted a safe car. She searched Facebook Marketplace car sale scam. Finally, she found a 2015 Infiniti QX60. The listing price was $9,000. She negotiated with the seller and they agreed on $8,500. That was all her savings. Two years earlier, she had a slip-and-fall accident. The settlement was her only financial cushion.

After she paid, Mizell drove the car home. The next day, she noticed big problems. The gas pedal had no power. The dashboard was lighting up with multiple warnings. Rain was leaking in during storms. She was worried and unsafe to drive.

She went to an Infiniti dealership in Sarasota. They looked at the car and told her some bad news. Records showed the same car had been in twice that year. Both times were after accidents and poor repairs. The dealer confirmed the seller knew about these issues. Mizell went back to the seller and asked for a refund. He refused, saying the car was sold “as is”. She lost all her savings in one deal.

Scams on Facebook Marketplace

Mizell’s story is a warning. Facebook Marketplace scams are growing every year. Cybersecurity researchers saw a 200% increase in scams between 2023 and 2024. Over 60% of US Facebook users reported being scammed. That’s a big risk.

Scammers exploit the trust in Marketplace. Buyers meet strangers and accept deals quickly. Scammers take advantage of that trust. They create convincing listings with good photos. Also They offer low prices and limited-time offers. They pressure buyers to act before investigating. Once money changes hands, scammers disappear or refuse refunds. Victims lose, are embarrassed and recover for a long time.

Mizell trusted the seller because the car looked clean. He answered her questions confidently. She thought the deal was safe. Unfortunately, scammers prepare scripts. They sound convincing and rehearse excuses.

Also read: Hatteras Island Evacuation Ordered as Hurricane Erin Nears

How Marketplace Scams Work

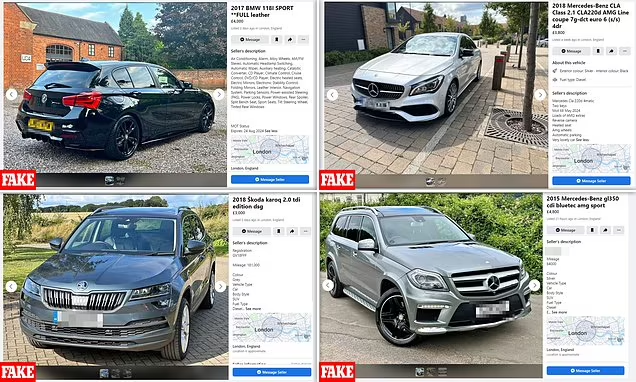

Facebook Marketplace scams come in many forms. Scammers use many tricks to catch buyers.

One common tactic is fake car sales. Criminals post cars for less than their market value. They create urgency by saying, “others have already called”. Buyers pay deposits. After payment, scammers disappear with the cash. Another is the “as is” sale with hidden problems. Cars look clean but have major defects. Scammers use contract loopholes to refuse refunds. Victims pay thousands and get stuck with costly repairs. Mizell’s case is an example of this.

Gift card scams are another method. Scammers ask buyers to pay with gift cards. Once buyers share the codes, the funds disappear. No refund is possible.

Verification code scams also harm users. Scammers ask for a 6-digit code “to confirm identity”. Once victims share it, scammers take over their accounts. They use stolen accounts to scam more people.

Payment Methods Fraudsters Target

Fraudsters like untraceable payment methods. Many demand Zelle, Cash App, or Venmo. These apps send money instantly. Once transferred, money never comes back.

Some scammers send fake Zelle confirmation emails. Victims think they got paid. Later, they find out no transfer happened. Others ask for wire transfers or prepaid debit cards. These methods have no buyer protection.

Legitimate buyers and sellers should use Facebook Checkout. That system has purchase protection. But many ignore it and use outside apps. Criminals like that because it reduces platform oversight.

Broader Scam Landscape

Mizell’s story is just one example. Across the US, similar scams happen daily. A Michigan woman lost her entire savings in a fake car deal. She wired money for a car that never showed up. She believed the seller’s story until it was too late.

Houston residents reported fake Zelle scams on Marketplace. Fraudsters tricked buyers with fake confirmation emails. Victims sent goods without payment never reached their accounts. Across the country, police departments are warning about Marketplace fraud. They tell citizens to use “safe zones”. That means police station parking lots with cameras. That’s where robberies and fraud happen less.

Safety Tips

Cybersecurity experts say education. Consumers must learn scam patterns. Knowledge is power.

Norton’s online safety team warns about phishing links. Scammers send fake websites to steal credentials. Never click on unknown links. Always check the web address.

Experts also say that strong account security. Two-factor authentication prevents account hijacking. Scammers need login access to expand schemes. Victims who secure accounts reduce risk.

Law enforcement tells us to report scams immediately. Quick reporting helps track criminals. Delayed action reduces recovery chances. Facebook also removes accounts reported by multiple people.

The Role of Technology

AI tools now detect scams. Norton has Genie, an AI assistant. It scans suspicious messages and warns you. Other cybersecurity companies are building similar tools.

Facebook invests in fraud detection. Algorithms look for fake listings and stolen photos. But scammers adapt. They change tactics to get around filters.

Experts say technology helps, but can’t replace human awareness. We must stay vigilant despite the tools.

Also read: M-23 And DR Congo Fail To Secure Peace Deal Agreement

Policy and Platform Responsibility

Critics say platforms must do more. Facebook makes money from Marketplace. So they have a responsibility to protect us.

Consumer advocates want stronger purchase protections. They want refunds for victims of fraudulent listings. Others suggest stricter seller verification. Requiring ID checks may reduce fake accounts.

Lawmakers are discussing regulations. They’re debating whether platforms should be penalized for repeated scams. Regulations may force companies to act faster.

Until then, we must use our caution. Platforms give us tools, but we must use them.