By Milton Allimadi

Photos: By Black Star News

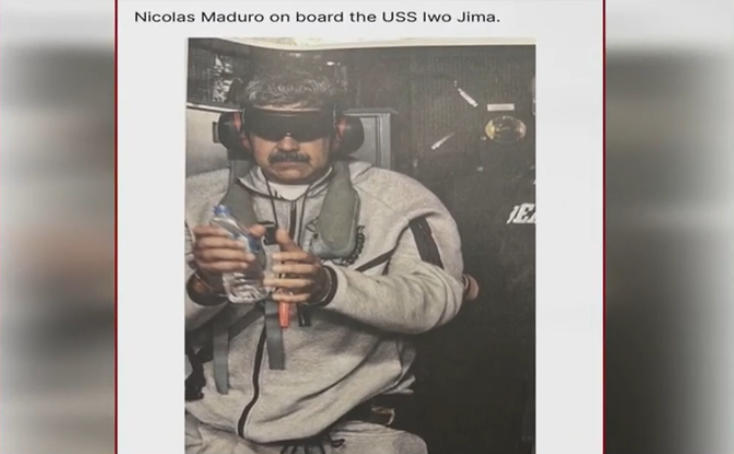

Above photo: Elderly home-owner Ms. Bobrowsky claims years of harassment by plaintiff eyeing her property.

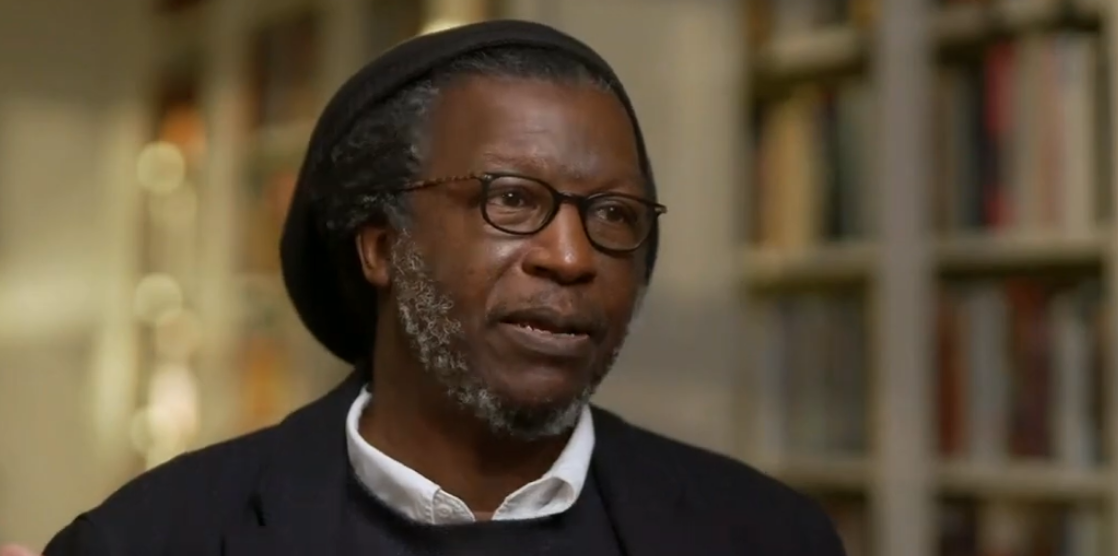

Bottom photo: Ms. Bobrowsky standing by Dr. King’s statue in front of the court house. What kind of justice?

An elderly Yonkers, New York woman claims she’s the victim of an ongoing years-long wrongful foreclosure case even though she hasn’t missed a mortgage payment since January 2003.

Ms. Shereen Bobrowsky, who’s in her 70s, makes her monthly payments with a money order.

She’s also apparently the victim of harassment. She says once a month, an unidentified man who claimed he works for the plaintiff comes to “inspect” her home and takes her photographs while she’s on the property. She claims the man once reportedly even peered inside her window.

“I don’t even know who is wrongfully suing me,” says Ms. Bobrowsky.

The caption on the case identifies the plaintiff as: US Bank Trust National Association, Not In Its Individual Capacity But Solely As Owner Trustee for REO Trust 20178-RPL1.

A hearing scheduled for Oct. 10, 2024 before Judge Paul I. Marx in the Westchester County Court was postponed until Oct. 21. The previous day, Black Star News had sent a list of questions to Max Saglimbeni, an associate with Knuckles Komosinki & Manfro, LLP., who’d made the last court appearance Aug. 27, 2024 on behalf of the plaintiff. That court session was covered by Black Star News’ Colin Benjamin.

Mr. Saglimbeni didn’t respond to a question sent via e-mail message by Black Star News about Ms. Bobrowsky’s claim that she hadn’t missed a single payment in over 20 years. He also didn’t respond when asked if the man who visits Ms. Bobrowsky’s property once a month works for his client.

In fact, Ms. Bobrowsky received a letter dated Oct. 1, 2024 from Rushmore Loan Management Services stating that her payment was up to date: “We are writing to notify you that your account is currently paid ahead. As of the date of this letter, you are due for your 12/01/2024 payment.”

During the Aug. 27 hearing Judge Marx directed the plaintiff, through counsel Saglimbeni, produce to Ms. Bobrowsky by Sept. 30, 2024: the complete payment history; a copy of the promissory note and of all assignments and the attached allonges; a copy of the mortgage; a copy of all default notices, including the 90 day notice prior to initiating foreclosure as required by New York law; a copy of the affidavit of service; and any documents he intended to use for a summary judgment motion he said he would file.

Ms. Bobrowsky told Black Star News that as of Sept. 30 she hadn’t been provided all of the documents as directed by Judge Marx nor had she received the complete accounting.

Previously the plaintiff had also failed to provide the complete history of payments when directed to do so on Dec. 21, 2023 by court attorney referee, Sheila Gabay, when the matter was in settlement conference in August, Ms. Bobrowsky said.

Ms. Bobrowsky has alleged that the signature attributed to Ms. Theresa Barrett, as the person who signed and notarized that she witnessed Ms. Tamara Sulea execute an assignment of mortgage on September 6, 2019 is “a forgery”—an allegation which has since been confirmed by the authorities in Los Angeles, Ca., where Ms. Barrett’s notary oath is kept, Ms. Bobrowsky said.

What’s more, Ms. Bobrowsky claims, the purported assignment of mortgage filed in the Westchester County clerk’s office is also fraudulent. The document states that it was executed on Nov. 6, 2019, which is two months after Ms. Barnett’s signature—the same signature Ms. Bobrowsky claims was forged. Mr. Saglimbeni also didn’t respond to this allegation.

“That’s like someone suing you two months before you hit them with your car in an accident,” Ms. Bobrowsky said. “I may be elderly but I’m not a fool.”

Ms. Bobrowsky says this is the third attempt to wrongfully foreclose on her property. Two previous actions—one in 2016 and another in 2020—should have been dismissed when the plaintiff couldn’t produce documents, she said. “Instead, the cases were discontinued for no reason at the request of the plaintiff over my objection and my demand for cost and fees,” she says. “The many years of trauma and ongoing harassment by plaintiffs has seriously affected my health.”

Meanwhile, Knuckles Komosinki & Manfro, LLP, the firm representing the plaintiff has sent her bills in excess of $30,000 for their legal fees for work they’ve done for their client, Ms. Bobrowsky said.

Mr. Saglimbeni didn’t respond when asked about the legal fees and whether this had been authorized by the court and whether Judge Marx was aware of it.

Ms. Bobrowsky claims she’s reported the alleged forged purported Ms. Barnett signature to the Yonkers Police Department and the Westchester County District Attorney.

The detective with the Yonkers Police who is handling the case, according to Ms. Bobrowsky, and the District Attorney’s office, didn’t respond to an e-mail message from Black Star News.

Editor’s Note: If you’re facing wrongful foreclosure and have solid documentation please reach the author via [email protected]