By Semafor Africa

Photos: YouTube Screenshots

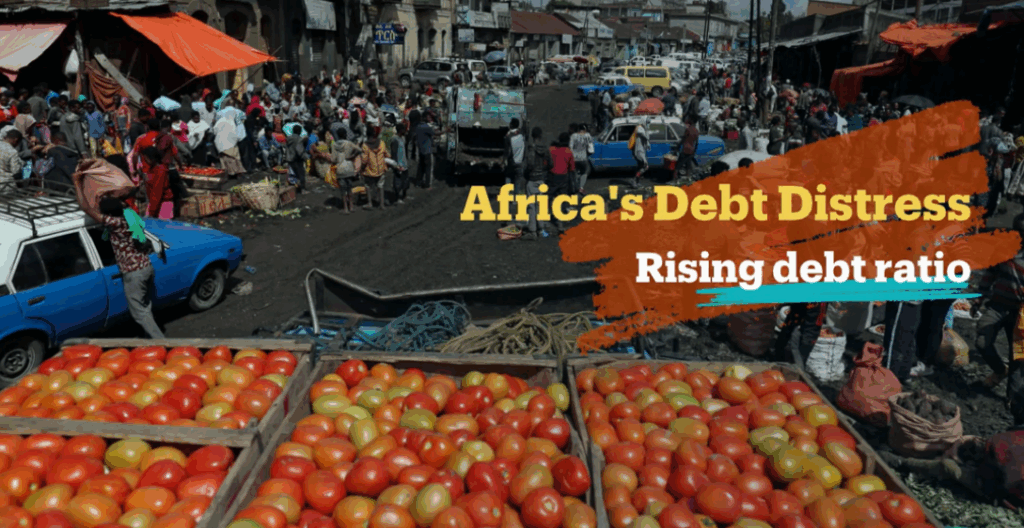

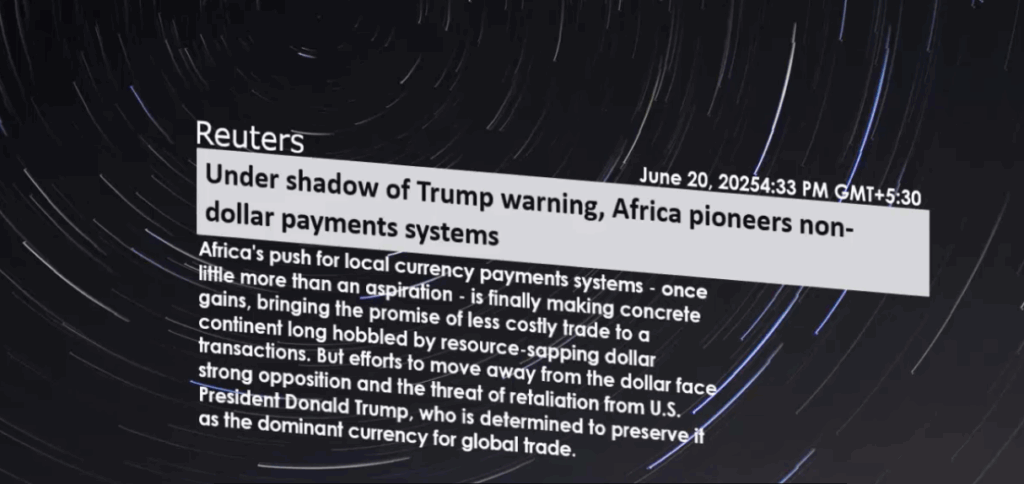

Angola raised $1.75 billion through a eurobond offering, its first issue in three years, making it the latest African nation to sell dollar-denominated debt.

Kenya’s $1.5 billion eurobond sale last week was almost five times oversubscribed, which points to the demand for high-yielding bonds from African issuers.

A number of African countries are considering debt offers at a time when the region’s improving economic outlook is likely to reduce perceptions of risk among global investors.

Nigeria is looking to raise $2.8 billion in new loans that would include a $500 million Islamic bond sold to international markets, while DR Congo is also preparing to raise $1.5 billion by issuing a eurobond to finance infrastructure projects.

However, at least 23 countries in sub-Saharan Africa are in debt distress or at high risk of distress, the World Bank’s recent assessment noted, with public debt in nominal terms and as a share of GDP nearly doubling over the last decade. The still elevated risk of sovereign defaults carries “significant implications for fiscal stability and development outcomes,” the bank said.

Jim Hightower’s Lowdown is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

To Support our independent investigative journalism contributions are welcome via Cashapp to: $BlackStarNews