The Dow Jones Industrial Average (DJIA) is a highly prized stock market index that includes 30 prominent, often blue-chip organizations on American stock exchanges. Praised for its ability to give people an impression of the state of the country’s economy, the DJIA makes it easier for me to understand market trends. In today’s trading session, investors are very interested in the main ideas about key stocks that may influence the trading results.

DJIA Performance Overview

The DJIA performed well last week, going up almost 2%. Its activity reflected the positive sentiment among investors, which was reflected in a decline in Treasury yields and higher-than-expected earnings results. Today, the focus shifts to several stocks that make up the DJIA that appear to have original breakouts or could be establishing themselves for consistent gains.

Also read: Top AI Stocks to Watch in 2025: Nvidia, Microsoft & More

DJIA Stocks in Focus

Nvidia (NVDA):

Although the company is not included in the DJIA, it can potentially strongly impact the overall market sentiment. Nvidia’s latest reports show that the AI chip division has been growing steadily, albeit the stock seems quite volatile. Those interested in technologies predicting the development of the industry are willing to see that Nvidia remains a market leader in AI.

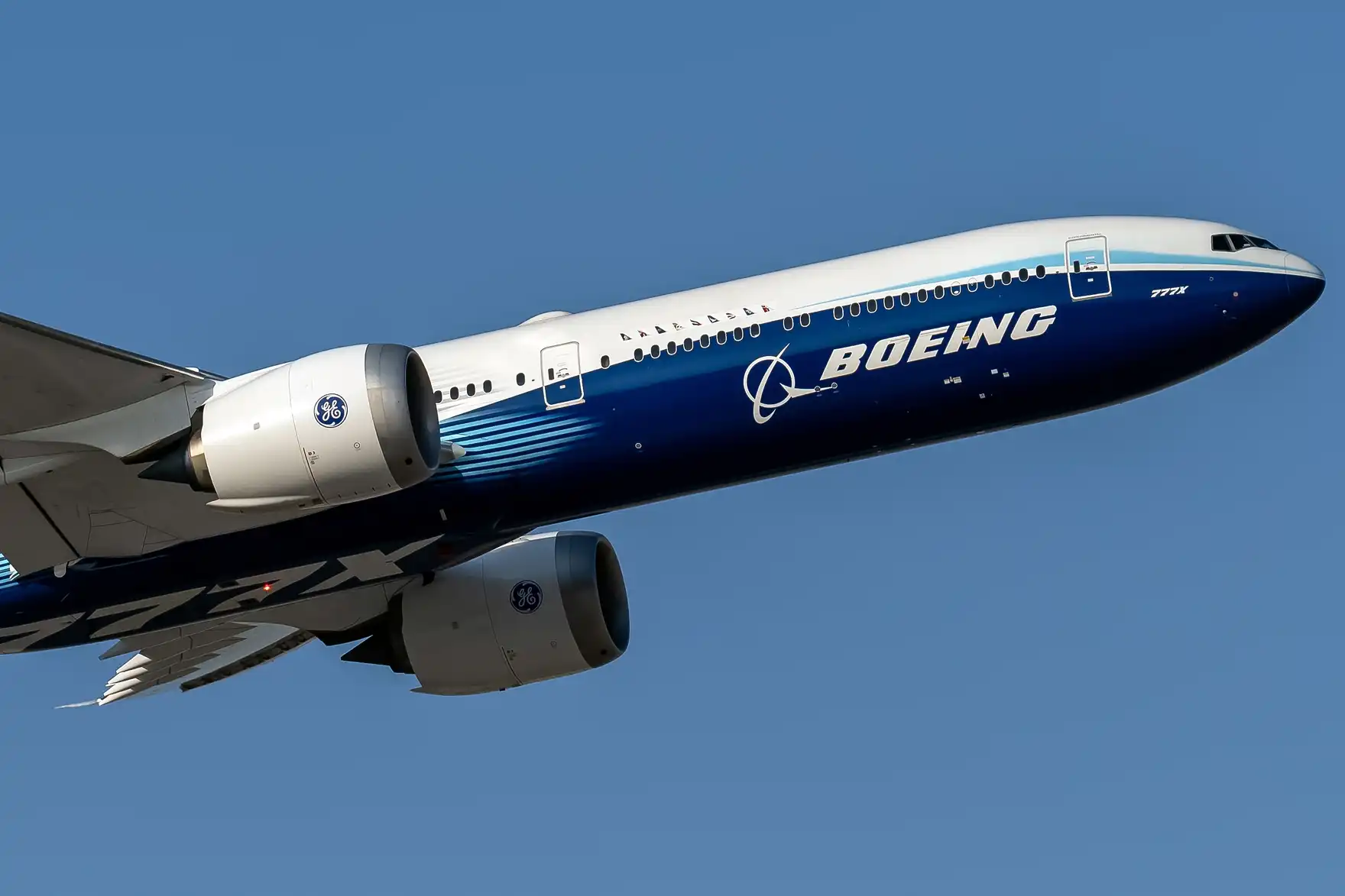

Boeing (BA):

Boeing remains the focus and remains in the limelight with the market for aerodynamics and with escalating orders for air communication and defense services. Encouraging trends in its production lines and orders in abeyance are working further in favor of investors.

Apple (AAPL):

That explains why the company always has steady product demand and high service revenue, making it a very strong stock in the technology sector. Analysts are paying close attention to the company’s market planning, especially in the run-up to the holiday selling season.

Microsoft (MSFT):

Microsoft is still a dark horse in the list of tech giants in the cloud computing and AI business. They are looking at the sources and development of machine learning and artificial intelligence, in particular, to understand sustainable growth.

Johnson & Johnson (JNJ):

Still, Johnson & Johnson can be considered as popular among defensive investors due to the company’s high-level resilience. Consumer healthcare products, together with prescription medicines and diagnostics, provide stability during times of change.

Market Trends to Watch

Treasury yields and crude oil prices remain other critical stimuli for the oscillation of DJIA. A decline in Treasury yields as observed in the previous week tends to drive stock growth, and movements in energy prices affect industrial/transportation.

Conclusion

Before the bell signifies the start of another trading day in the DJIA, investors must ensure that they get up-to-date information on the companies and the general market. New economy sectors like technology, healthcare, and industrials are diverse; hence the future opportunities are also fast, both in the short term and the long term.

Managers must always analyze the big boys and new sensations moving within the sector. Be alert, change your actions, and use market information to optimize portfolio results.