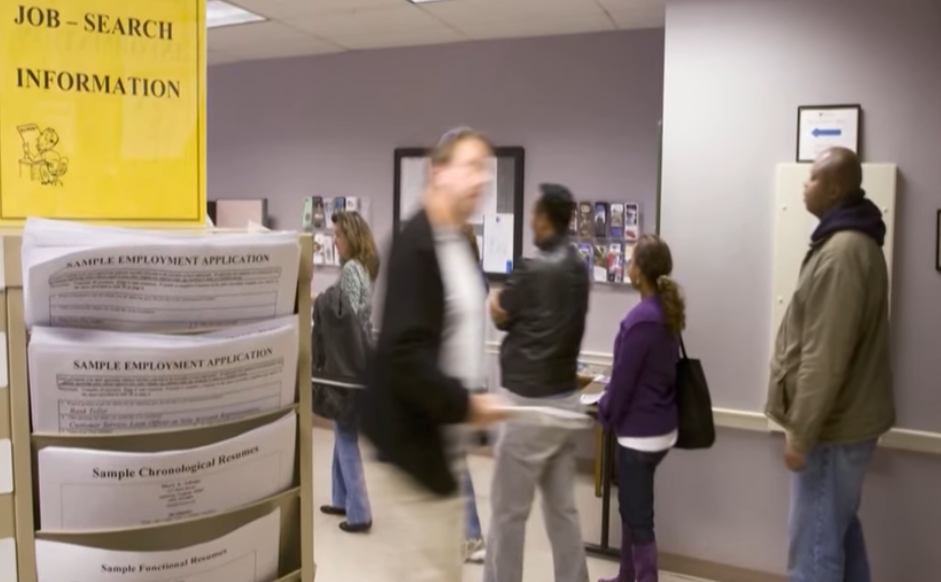

The new scoring model could lead to more credit approvals for people who have credit scores in the upper 500s or lower 600s. Consumers who have a limited credit history or those who are rebuilding their credit should benefit the most from the new score, according to FICO.

Instead of a lender just looking at your credit history and the traditional components that make up your scores such as payment history (35%), amounts owed (30%), length of credit history (15%), credit mix (10%) and new credit (10%), a lender using the UltraFICO scoring model would look at your banking behavior and use your banking history to grant you credit.

Your banking history you say? Yes! A lender, (with your permission) would look at your financial data related to your banking and make a decision. What would be the criteria?

The UltraFICO score will use additional information based on your bank account activities. The score will be based on four main criteria:

My opinion? The “pros” are this scoring model can be very helpful for consumers who are struggling to “build” credit, or are bouncing back from “bad credit” if they have great banking habits this can give them the boost they need for a credit approval.

The “cons” are releasing your financial data and banking info and putting it in the hands of the same bureaus who often experience security breaches will/can only lead to more identity thefts and more breaches of consumers personal information.

Either way, this scoring model is a opt-in program and it will be up to the consumer if they want to share such information.

In need of credit repair? Are you looking to enhance your credit profile but don’t know where to start? Do you have poor credit and are constantly being denied for credit?

Contact us today! 1-877-335-8865. Fill out our secure consultation form below, for a limited time we are performing credit audits for $49 (normally $99) Sign on with a credit monitoring site for a free trial period, pull your credit reports/scores and we will perform a detailed assessment of your 3 credit reports and scores.

Find out what you need to improve!