[COVID-19\Corporate Tax Cuts]

“Such undesirable tax strategies also include payroll tax cuts. They would provide little immediate stimulus to the economy because they would be relatively inefficient and paid out in small increments over time.”

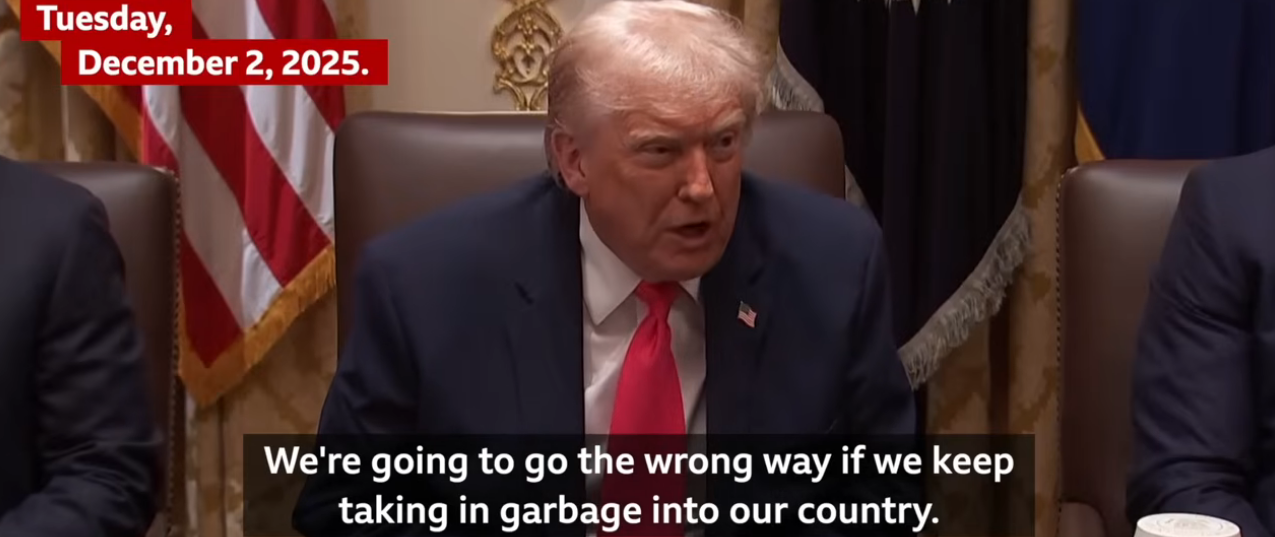

Photo: YouTube

Should Congress be focused on giving corporations tax breaks during COVID-19 crisis?

A diverse coalition of national groups cautioned Congress Tuesday not to use the novel coronavirus emergency as an excuse to lavish more tax cuts on the wealthy and corporations or to enact payroll tax cuts.

Tuesday, 60 groups argued in a letter to the House and Senate for “an aggressive response to the economic and societal impact of the novel coronavirus outbreak, but caution[ed] against allowing this national emergency to be used to demand tax cuts that will be poorly targeted, lack the biggest bang-for-the-buck and favor those families that have the most resources to weather the crisis.”

The groups wrote: “Such undesirable tax strategies also include payroll tax cuts. They would provide little immediate stimulus to the economy because they would be relatively inefficient and paid out in small increments over time. Moreover, payroll tax cuts provide the largest weekly payout to those who least need them and are least likely to spend them. For example, the Penn Wharton Budget Model estimated that a 2-percentage point payroll tax cut over an entire year would give an average of just $50 to those in the bottom 20% of the population and an average $410 to those in the next 20%. The richest 10% would each save an average of about $3,000. Workers laid off and those unable to find employment due to the Covid-19 emergency would of course get nothing at all.”

The groups instead suggested Congress consider economic remedies proposed recently by several leading economists, including immediate substantial cash payments to all households and increased federal support for the states, especially to cover Medicaid and other healthcare spending, and paid sick leave.