Photos: Video\YouTube Screenshots

LOUISVILLE, Kentucky, November 7, 2023 — As fears continue to grow over AI and its ability to discriminate against minorities and other protected populations, insurers are seeking new ways to utilize technology to make policies more inclusive for underserved populations.

Effective November 14th, a new regulation adopted by the Colorado Division of Insurance (CDI) prohibits life insurance companies from using external consumer data and information sources, algorithms, and predictive models to discriminate based on race.(1)

This new law comes at a time when consumer fear is at an all time high over the ways in which insurers are using data and predictive modeling against them, unfairly preventing them from securing affordable life insurance policies.

What most consumers are unaware of is the fact that the majority of life insurance companies are severely behind the times, only looking at data through the scope of five major data points: age, gender, zip code, smoker/non-smoker, and marital status. While more data than ever is available, this narrowed scope continues to lead to major blindspots in the underwriting process.

“We think about data and data points like a television. In the early days, the picture was grainier because there were far less pixels, less data points. Today, there’s way more data points, more pixels, creating a clearer picture of the consumer, which can make insurance underwriting far more inclusive,” says Bryan Simms, Co-Founder and President of Mammoth Life & Reinsurance Company (MLRC)

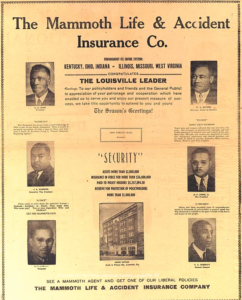

MLRC was named after Mammoth Life and Accident Insurance Company, which was established in 1915 by former slaves who pooled their resources to self-insure after being marginalized and rejected by mainstream insurance markets. Relaunched in 2021, MLRC uses AI and machine learning to look at 100s of datapoints in order to make the underwriting process more inclusive for underserved populations.

One way that technology is being used to make insurance more inclusive revolves around how credit scores are evaluated. FICO scores are often used against individuals, yet they are only one data point showing a consumer’s level of fiscal responsibility. A consumer’s ability to pay all of their bills on time, for example, shows a company like Mammoth Life that they are motivated to take care of their families, that they’re trying to live a lifestyle that protects their family. That’s a good thing for life insurance.

Using technology to more efficiently analyze health data is also an important step in making life insurance more inclusive for consumers. When consumers undergo the application process for life insurance, they are often required to go in for a health screening. The cost to schedule, the cost of the appointment, the lab costs, and the costs of evaluating lab results all factor into higher policy premiums for the consumer. The majority of applicants have already been to the doctor or gotten bloodwork done. By giving permission to insurers to review existing health data, it helps reduce the overall premium, leading to more affordable and inclusive policies for Individuals who would typically be seen as risky, who might be people of color, or disproportionately subject to higher instances of diabetes, hypertension, or high cholesterol.

“Nearly 50% of Americans are uninsured or underinsured and life insurance is one of the most important keys to helping these individuals plan for their family’s future,” says Bryan Simms. “If we’re able to help them become savvier consumers and financial stewards by being more inclusive in our underwriting process, it means better life outcomes, health outcomes, and the opportunity for people to become more upwardly mobile. That’s our motivation and why inclusivity is important to us.”

Mammoth Life & Reinsurance Company was founded in 2021 as an inspired brand, reviving the legacy established by Mammoth Life and Accident Insurance Company, which was established in 1915 in Louisville, Kentucky by former slaves that pooled resources to self-insure after being marginalized and rejected by mainstream insurance markets. Mammoth Life’s mission is to deliver accessible and inclusive insurance products and solutions into the market aimed at the uninsured and underinsured life insurance demographics. MLRC is a nimble, responsive, data-driven distribution company leveraging its unique and proprietary product engineering capacity coupled with its consumer engagement technology and use of data science and generative AI.

Sources: