Within the domain of Cryptocurrency assets, Bitcoin has for the first time crossed the $93,000 mark in history. This signifies that the post-election price rise in the U.S. is still ongoing. On election night, Bitcoin was trading below $70,000, since the spot bitcoin exchange-traded funds (EFT’s) were introduced in January. Post-election developments, however, paint a different picture. After surpassing the $93,000 mark on November 13, 2024, Bitcoin continued to grow. The EFTs are at an all-time high as a result of Donald Trump being re-elected as president of the United States. To learn about the factors that led to Bitcoin surpassing $93,000, continue reading below.

Also read : Bitcoin Crosses $89,000: What’s Next for the Leading Cryptocurrency?

Significance of Bitcoin crossing $93,000 mark

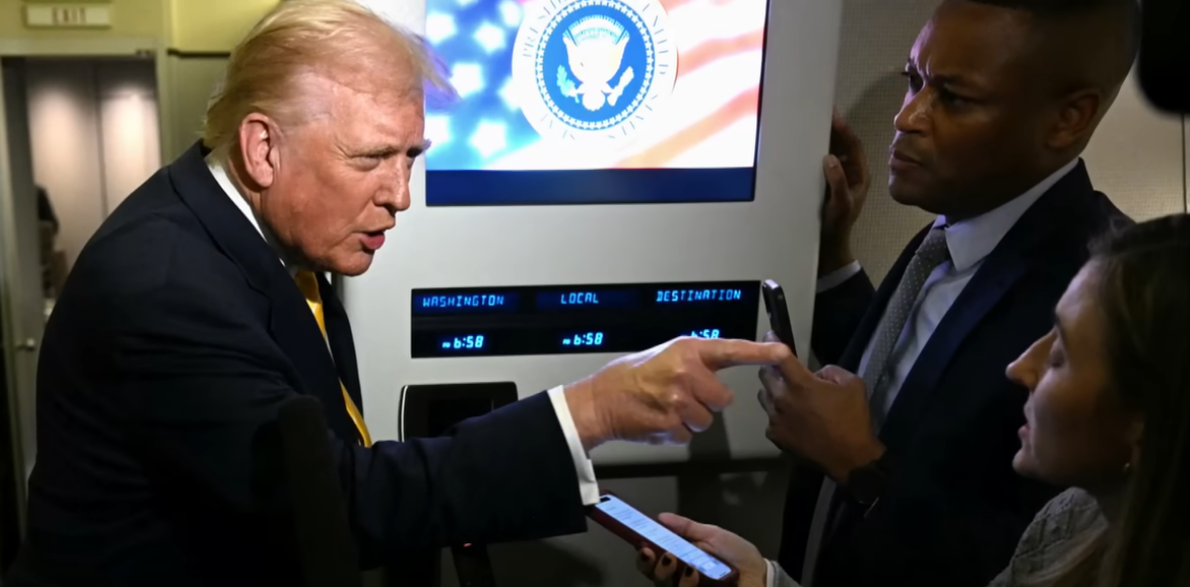

Trump’s initiative towards more crypto-friendly policies through his pledge to make the US a global trailblazer in digital assets could mean a further rise in Bitcoin’s future. What this initiative holds is more innovation and newer avenues for institutional investment. This could altogether change the game for cryptocurrencies in the U.S. Bitcoin has increased by more than 21% in the last seven days.

Bitcoin crosses $93,000: Reasons

The topmost reason for the market’s top cryptocurrency, Bitcoin, rising sharply as a result of the certainty surrounding the U.S. presidential election and the triumph of Republican nominee Donald Trump. Another issue is the recent 25 basis point rate drop by the Federal Reserve, which brought the rate down to a range of 4.50% to 4.75%.

CoinDesk claims that Coinbase, a renowned cryptocurrency exchange preferred by US institutions and investors, accounts for a generous portion of spot trading traffic. The Coinbase Premium Index, which measures the price difference between Coinbase and other exchanges, also soared during this surge. A superior premium could mean institutional demand responsible for Bitcoin’s present surge. It could also indicate substantial purchasing interest from US-based investors.

The demand for US exchange-traded funds and recent rate cuts by the Federal Reserve have combined to drive a 94% increase in the value of bitcoin in 2024. According to CoinDesk, Bitcoin experienced its second-best week of the year with a 17 percent rise last week alone.

What could it mean for future Crypto investors?

CoinDCX co-founder, Sumit Gupta mentions that the end of the crypto winter and the development of a more resilient digital asset ecosystem could result from even wider institutional adoption if regulatory frameworks improve. The next significant psychological milestone for Bitcoin is $100,000, which may be attained with the help of additional institutional inflows, the growth of ETFs, and favorable legislative changes. Bitcoin is a tempting asset in diverse portfolios because of its momentum as well as its distinctive fundamentals of scarcity, decentralization, and institutional acceptance.

Nikhil Sethi, the creator and managing director of Zuvomo, stated that since Trump’s victory, Bitcoin has surged as investors anticipate more open regulations that might promote widespread use. The historical milestone of Bitcoin ETF adoption has been a significant step in strengthening Bitcoin’s validity in the financial sector.

Other Crypto Currencies that are soaring right now

Along with this, other cryptocurrencies that are soaring right now include Ethereum (ETH) with a market price of $3239.05 (November 12, 2024). Next to it is Tether (USTD) displaying a market price of $1.00 (November 11, 2024). Third on the list is Solana (SOL) with a market price of $212.07 (November 11, 2024), and lastly Binance Coin (BNB) with a market price of $625.73 (November 12, 2024). These are the top 5 cryptocurrencies in the world right now. However, the data may change based on market fluctuations among these five.

Also read : Bitcoin Hits All-Time High 80000 Dollar Now, Forecast for Next Week

Future trends on Bitcoin

Bitcoin’s price forecast input from Binance indicates that by 2030, the value of BTC might rise by +5% to $107,124.58. A bullish current sentiment is shown by the consensus rating. Based on 3584 users’ cryptocurrency ratings for Bitcoin (BTC), 36.69% of users are positive about the cryptocurrency. According to Cashaa’s co-founder and CEO, Amjad Raza Khan, hitting $1,000,000 by 2025 is a lofty goal for Bitcoin, requiring exceptional market conditions to drive prices up by more than 1,100% in just over a year. Significant institutional adoption, pervasive global economic turmoil (which drives investors to look for alternative assets), and a sharp decline in the amount of Bitcoin available due to holding and scarcity effects are all necessary for this level.