Photos: YouTube Screenshots

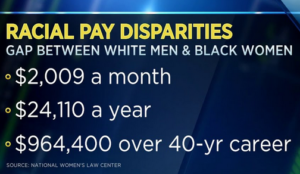

Washington, D.C. — A new Center for American Progress analysis of the Federal Reserve’s 2022 update to the Survey of Household Economics and Decisionmaking finds that women were less likely than men to be financially secure and that women of color were particularly at risk.

While several factors contribute to gaps in financial well-being between women and men, the gender wage gap continues to hinder women’s financial security and make it more difficult for women to accumulate savings.

This original CAP analysis fills knowledge gaps in the analysis provided by the Federal Reserve by focusing on gender and suggests ways to improve women’s financial security as COVID-19-era policies, such as the student loan moratorium and child care stabilization funds, taper off and women’s and men’s financial security realigns with pre-pandemic levels.

While the most recent economic data indicate improving conditions overall, the persistent gaps in both women’s pay and resilience to financial risk mean that it remains essential for policymakers to address the root causes of the gaps in women’s financial well-being.

Some of the top-line takeaways from the analysis include that in 2022, women were:

- Less likely (at 79 percent) than men (at 84 percent) to be able to pay all their bills on time and in full.

- Less likely (at 52 percent) than men (at 56 percent) to be able to cover three months of expenses with emergency savings.

- More likely (at 15 percent) than men (at 12 percent) to have increased their usage of credit card debt.

“While women have continued to smash employment records, the persistent wage gap continues to hinder women’s financial security, particularly for women of color,” said Sara Estep, associate director of the Women’s Initiative at CAP and author of the column. “The Biden administration’s economic legislation prioritizing support for parents is an integral step for mothers to work toward building financial security. Congress must increase the minimum wage to help close the gender and racial wage gap and help expand women’s financial security.”

Read the column: “Women’s Financial Well-Being in 2022” by Sara Estep