Photo: CassisiLaw.com

Frank Cassisi, (above) the attorney who filed an alleged forged retainer “agreement” in a bankruptcy case also filed several documents that may have been forged in a $5 million personal injury case in New York State Supreme Court, records show.

The report of his filing of an undated retainer “agreement” first appeared in a Black Star News article on Oct. 4, 2022.

Cassisi currently represents Alan Nisselson, trustee in Ashmeen Modikhan’s chapter 7 bankruptcy case in the Eastern District of New York. Cassisi previously represented Modikhan when she sued Golden Touch Transportation of New York Inc., in State Court, Queens County in 2015. Modikhan’s right hand was crushed in 2014 by the door of a bus used to ferry American Airlines employees between terminals and car parks. She suffered career-ending injuries and lives in constant pain. The bus was operated by Golden Touch Transportation of New York Inc.

Prior to the personal injury case, Modikhan alleges, she was the victim of two illegal foreclosure proceedings, one in 2010 and the other in 2012. She filed for bankruptcy in 2012 and received a discharge in October of 2012 over her properties: a condominium in the Howard Beach section of Queens and the other, her residence in Magnolia Court, also in Queens. In 2014 the illegal foreclosures on both properties started again. The Howard Beach action was dismissed on June 27, 2014 because the plaintiff, represented by the notorious Rosicki, Rosicki & Associates firm didn’t have the promissory note. A new law firm, Gross Polowy LLC, pursued foreclosure on the Magnolia property and also proceedings on the Howard Beach property restored in 2017.

In bankruptcy court, the Eastern District of New York, Modikhan suffered a series of adverse rulings by Judge Jil Mazer-Marino. Court records reviewed by Black Star News show that a lawyer named Courtney Williams with Gross Polowy filed false proofs of claim (POCs) on behalf of parties that Modikhan claims were not the true creditors but “zombie debt collectors.” Filing of fraudulent POCs carries a penalty of $500,000 fine, or five years imprisonment, or both. Judge Mazer-Marino ignored the transgression and allowed Williams’ clients to wrongfully gain standing, Modikhan claims.

(Earlier, in chapter 13 bankruptcy proceeding’s, Modikhan alleges she was victim of a modification scam when Judge Elizabeth Stong presided over the case. Stong recused herself after Modikhan complained. Modikhan claims her then attorney Darren Aronow tricked her into payments totaling $90,567.26 from her exempted worker’s compensation fund under the guise it was for loan modification. Modikhan paid Aronow’s firm $14,500; she paid the chapter 13 trustee Marianne De Rosa $67,200; and she paid Rushmore Loan Management $8,867.28. Modikhan demanded an accounting which she never got. Aronow returned 13,065, De Rosa gave back $61,700 keeping $5,500, Rushmore, a purported servicer for a creditor, refused to refund her money. “The court never investigated this scam or take any action,” Modikhan said.

Homeowner Ashmeen Modikhan at the entrance of her Magnolia Court home

Judge Mazer-Marino dismissed with prejudice Modikhan’s adversarial action against all the parties except Aronow, whom she’s allowed Modikhan to sue; however Mazer-Marino herself is presiding over the action. “This is conflict of interest and unethical,” she said.

Judge Mazer-Marino lifted the stay on the sale of Modikhan’s properties in the State court, even though she’d made the court aware she was appealing her rulings. Modikhan ultimately filed an appeal in the district court against Judge Mazer-Marino’s rulings. The appeal was denied by Judge Eric Komitee; the judge also denied Modikhan’s motion for re-consideration in record time, one day.

The Gross Polowy firm eventually disappeared from the case, just as the Rosicki firm had done. A new firm, Friedman Vartolo LLP, now pressed the foreclosure case. Meanwhile, Modikhan filed court papers in State court asking that the foreclosure cases be dismissed because the plaintiffs never possessed her note and mortgage—which is required—in order to initiate a foreclosure, and as a result the court lacked jurisdiction. (Friedman Vartolo’s court papers lists U.S. Bank as the plaintiff. When Black Star News contacted U.S. Bank and asked if the Friedman firm had a retainer agreement to represent the bank in the foreclosure, a spokesperson said the bank only played the role of trustee and shared a handbook outlining obligations).

When Modikhan’s Howard Beach property was “auctioned” on October 14, 2022, it was “purchased” for $250,000 by the an attorney of Friedman Vartolo law firm named Michael W. Nardolillo, who is also listed as the representative of the plaintiff. “This was an illegal foreclosure and I will fight to get my properties back,” Modikhan said.

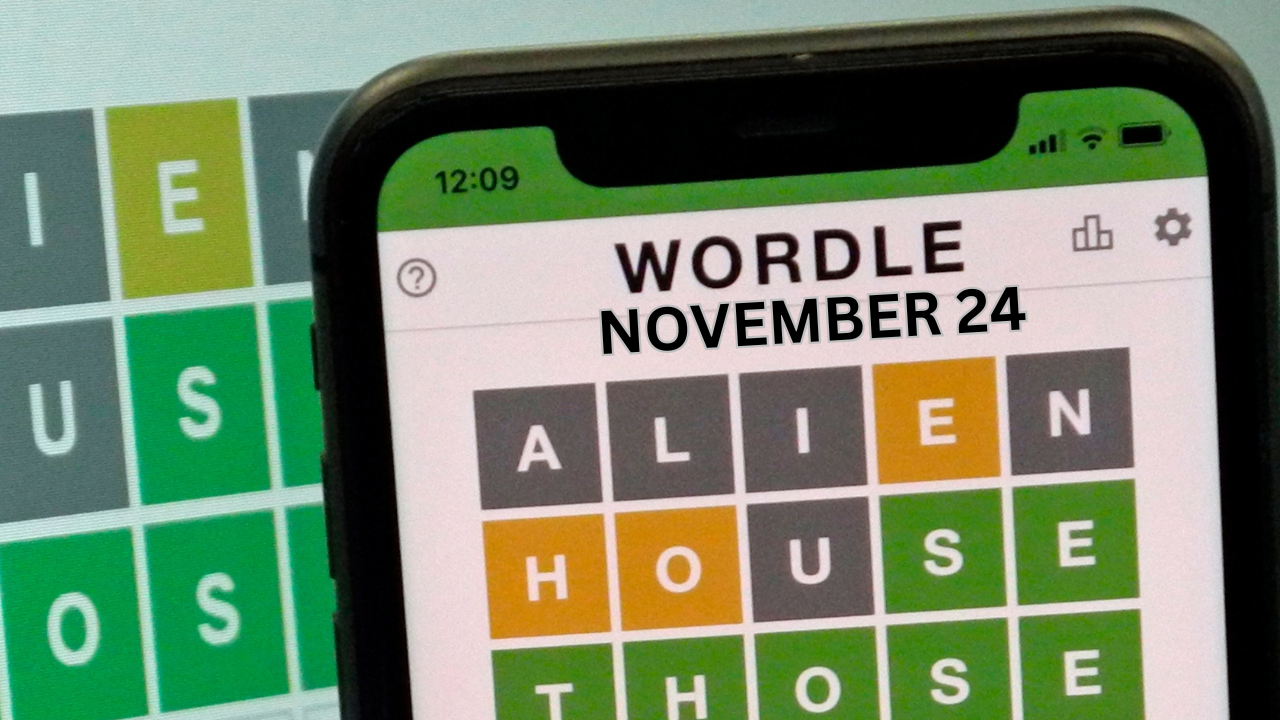

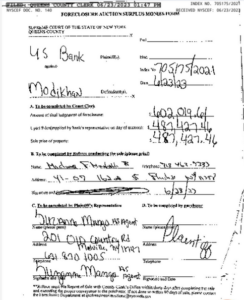

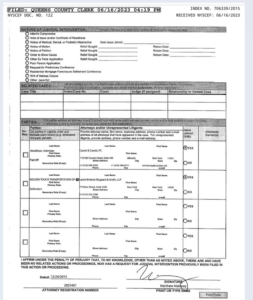

Friedman Vartolo also pressed for Modikhan’s Magnolia property to be auctioned, again claiming to represent U.S. Bank. No one bought the property up for the June 23, 2023, auction after an article in Black Star News article raised questions about the Howard Beach foreclosure. Yet, court records claim an auction was conducted by a referee named on Michael F. Mongelli on the scheduled with a person named Suzanne Mango acting as agent; she was also agent on sale of the Howard Beach property. A one-page form entitled “Foreclosure Auction Surplus Monies Form” has a signature attributed to Mongelli.

[A]

]

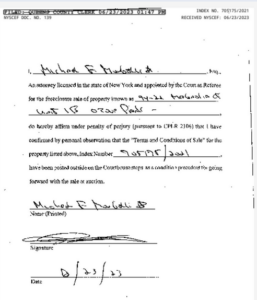

]

A second document where the referee affirms “under penalty of perjury” that he confirms “by personal observation” that the terms and conditions of the sale was “posted outside on the Courthouse steps” also bears a signature attributed to Mongelli. That signature bears little resemblance to the signature attributed to Mongelli on the first document.

[B]

Mongelli did not respond to an e-mail message from Black Star News asking him to verify the two signatures.

So how did Frank Cassisi and Modikhan’s $5 million lawsuit become entangled in these murky foreclosure proceedings?

After Judge Mazer-Marino allegedly ignored the false POCs filed by the Gross Polowy lawyer Courtney Williams, she also approved chapter 7 trustee Alan Nisselson’s motion to let him hire Cassisi, Modikhan’s lawyer as his own counsel. Mazer-Marino also approved his motion to settle Modikhan’s $5 million personal injury lawsuit—since it constituted part of her estate—for a mere $500,000 without any medical records or expert evaluation of the value of the law suit. The judge also approved that Cassisi be paid $166,666.666 as legal fees. She also approved Nisselson’s motion that Modikhan be given a mere $25,000—the allowable exemption—as her cut of the $500,000. “I can’t believe officers of the court in United States could be this cruel” Modikhan said.

Cassisi then filed papers in the bankruptcy court so he could start working with his new client, Nisselson.

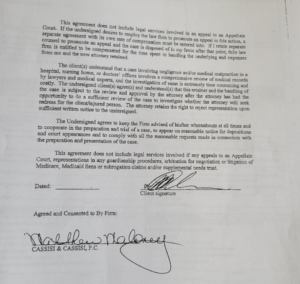

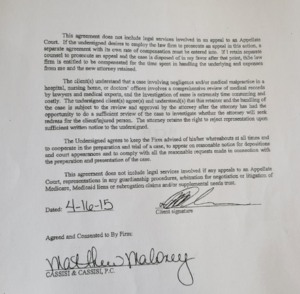

While reviewing the numerous documents filed in the bankruptcy court, Black Star News discovered that Cassisi filed an undated purported retainer “agreement” he’d executed with Modikhan. Black Star News compared a copy of the agreement in Modikhan’s possession with the version filed by Cassisi.

Not only was it undated, two sections on the “agreement” referring to how George Crozier, an American Airlines employee who’d introduced Modikhan to Cassisi would be paid, was hand-crossed out. Most significantly, the signature on the “agreement” attributed to Matthew Maloney, Cassisi’s former associate, doesn’t match Maloney’s signature on the version in Modikhan’s possession. Also, the section referring to Crozier remains on Modikhan’s version with no cross-out.

[C]

[D]

Bankruptcy Court Chief Judge Alan Trust declined to comment when contacted by Black Star News about this apparent Cassisi forgery. Judge Mazer-Marino also declined Modikhan’s request that she investigate the apparent Cassisi filing, during a court session attended by this reporter via Zoom. “I will fight to prevent my properties and my personal injury law suit from being stolen,” Modikhan said. She said she needs a neutral hearing where her adversaries don’t have “home court advantage.”

Cassisi, through his new associate Timothy Tenke, has filed papers in the State court asking Judge Maurice E. Muir, who is presiding over the personal injury case to replace Modikhan’s name with trustee Nisselson’s as the new plaintiff. “My debt was discharged in bankruptcy in 2012, meaning I had no legitimate creditors,” Modikhan says. “Now since my two properties have just been illegally sold to fake creditors why are they still after my personal injury law suit?” Modikhan said.

Black Star News decided to review documents filed by Cassisi in the State court in the personal injury case. The publication’s examination revealed that there are many documents with signatures attributed to Matthew Maloney, Cassisi’s former partner, that don’t match.

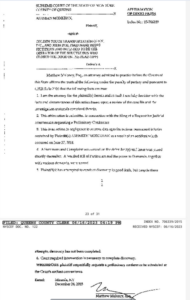

For example a document listed as “Request for Judicial Intervention” filed by the Cassisi firm on December 24, 2015, bears the following signature attributed to Maloney:

[E]

Another document listed as “Affirmation of Good Faith” also filed by the Cassisi firm on December 24, 2015 also bears a document attributed to Maloney:

[F]

Not only do these signatures not match, they also have zero resemblance to either signature on the retainer agreements—the one in Modikhan’s possession and the apparent forged one filed by Cassisi in the bankruptcy court. “If I filed so many forged documents I would be in jail by now,” Modikhan said. “All I want are my properties and my personal injury lawsuit so I can go to jury trial. I’m going to ask the judge to let me subpoena Cassisi and Maloney.”

According to a letter dated Sept. 12, 2022 from Samuel H. Younger, of the Attorney Registration Unit, New York Unified Court System, Maloney’s registration for the Cassisi & Cassisi firm was processed on Sept. 9, 2016. Yet, the signature on the “Request For Judicial Intervention” on December 24, 2015 is attributed to him.

The next court date on Modikhan’s personal injury case is July 27.

Modikhan outside her Howard Beach home

Maloney, who is now an associate at the law firm of Simmons Jannace Deluca, LLP, didn’t respond to an e-mail message from Black Star News, seeking comment.

Both Cassisi and his new associate Timothy Tenke didn’t respond to questions sent via e-mail message.

Lucian Chalfen, spokesperson for the New York Unified Courts System didn’t return an e-mail message seeking comment.