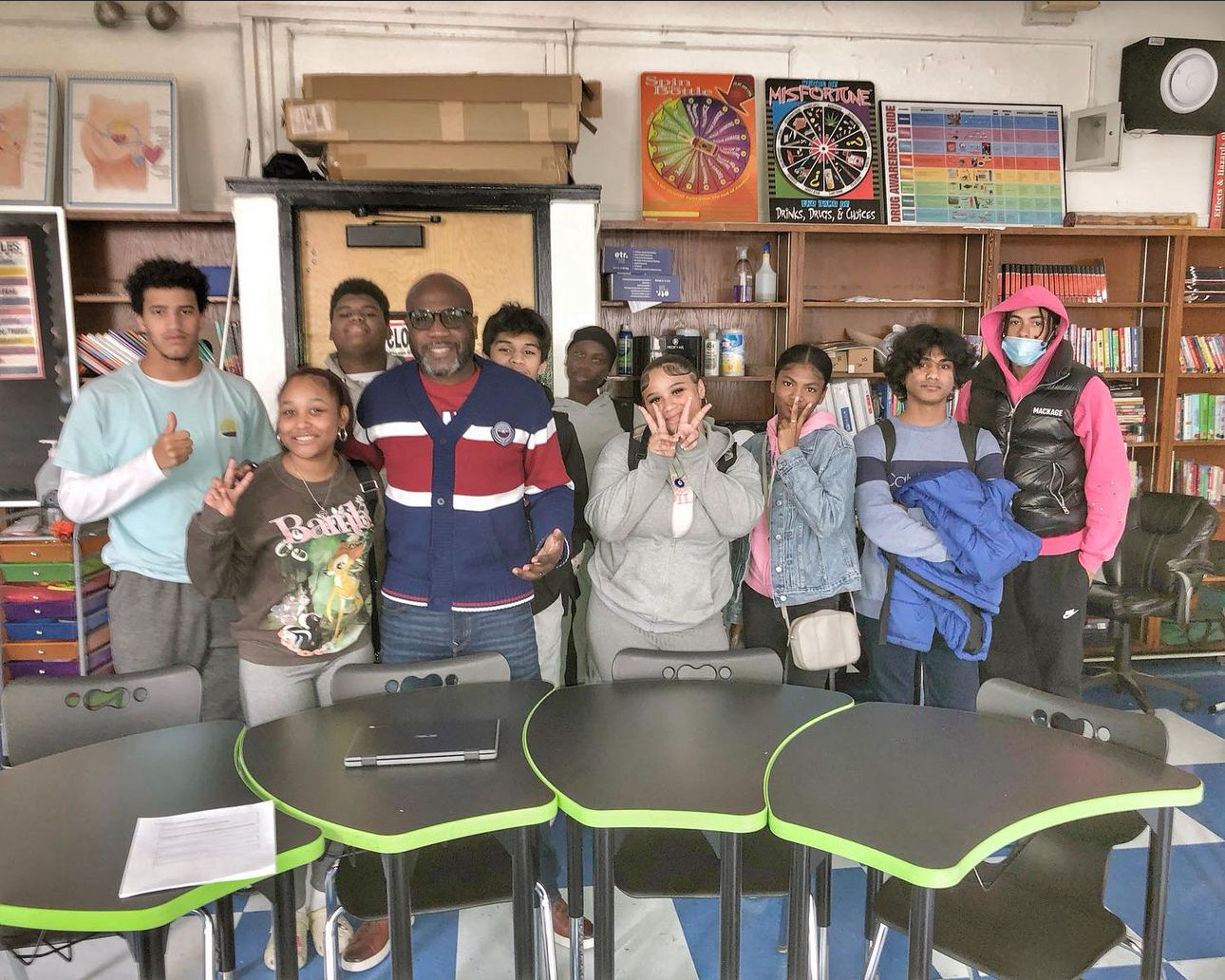

[Broadway Federal Bank\City First Bank]

William Michael Cunningham: “The lack of Black wealth means that you don’t have a community asset base you can utilize to create larger Black financial institutions. The money just isn’t there.”

Photo: Broadway Federal Bank

Los Angeles’ Broadway Federal Bank (above) and Washington, D.C.’s City First Bank are merging to form the largest Black-led bank in the U.S., underscoring the challenges such banks have faced in generating enough capital to effectively serve their communities.

Black-owned and -led banks have long been caught in a difficult cycle: They tend not to have enough money to lend to help their communities build wealth, and the resulting dearth of wealth-building opportunities diminishes the money available to flow into the banks. Efforts to remedy that include the grass-roots #BankBlack movement — as well as the merger announced Wednesday.

To really make a difference in high-cost markets such as L.A. and D.C., banks need to be able to write bigger checks, particularly to fund projects such as multifamily affordable housing or to finance small businesses and nonprofits, said Brian Argrett, chief executive of City First Bank. Those three areas will be the combined bank’s main focuses, he said.

The deal merging Broadway Federal’s parent, Broadway Financial Corp., and City First’s parent, CFBanc Corp., will create a combined entity with more than $1 billion in assets. Described as a merger of equals, the deal is expected to close in the first quarter of 2021, and, like Broadway Financial, the resulting firm will be publicly traded.

The merger will give the combined bank more capital and capability, allowing it to “direct more capital through loans and into the underlying communities that we both serve,” said Argrett, who will be CEO of the new, yet-unnamed entity.

For years, many Black-owned and -led banks have been limited by their relative lack of assets.

Last year there were 21 such banks in the U.S., down from 48 in 2001, according to the Federal Deposit Insurance Corp. Those 21 banks had assets totaling $4.85 billion.

That same year, the 33 Latino-owned or -led banks in the U.S. had $109 billion in assets and the 72 Asian-owned or -led banks had $129 billion in assets. Those totals pale in comparison with the holdings of the nation’s major banks: In July, for example, Wells Fargo said it had $1.97 trillion.

Black-owned and -led banks need to increase the number of checking and savings accounts, business lines of credit, mortgages and other loans to “significantly move the needle,” said William Michael Cunningham, economist and CEO of consulting firm Creative Investment Research.

“The lack of Black wealth means that you don’t have a community asset base you can utilize to create larger Black financial institutions,” he said. “The money just isn’t there.”

The Great Recession of 2007-09 hit Black-owned and -led banks and their borrowers especially hard. During that recession, median net wealth declined for Black families by 44.3%, compared with 26.1% for white families.

That disproportionate toll “had a filter effect onto Black businesses, including Black banks,” said Michael Neal, senior research associate in the Housing Finance Policy Center at the Urban Institute think tank.

Read rest of story here: https://www.latimes.com/business/story/2020-08-27/black-banks-broadway-federal-bank-city-first-merger