[COVID-19 Stimulus Funds\Debt Collectors]

“During this public health and economic crisis, the States do not believe that the billions of dollars appropriated by Congress to help keep hard-working Americans afloat should be subject to garnishment.”

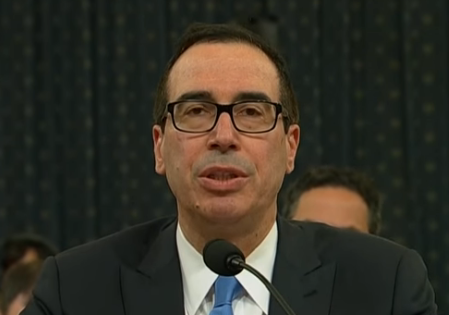

Photo: YouTube

New York’s Attorney General, and a coalition of other state attorneys general, have sent Treasury Secretary Steve Mnuchin a letter asking that debt collectors be disallowed from seizing COVID-19 funds from families.

New York Attorney General Letitia James today sent two letters to the federal government in an effort to help Americans deal with the ensuing economic fallout of the coronavirus disease 2019 (COVID-19) public health crisis.

First, Attorney General James led a bipartisan coalition of 25 attorneys general in sending a letter to Treasury Secretary Steven Mnuchin, calling on the U.S. Department of the Treasury to take immediate action to ensure billions of dollars in emergency stimulus payments authorized by the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) go to American families and not debt collectors. Congress passed the CARES Act three weeks ago to provide direct and immediate economic relief to all individuals and businesses affected by COVID-19, but — unlike other government programs — the CARES Act does not explicitly designate these emergency stimulus payments as exempt from garnishment from creditors. Attorney General James and the coalition are asking the agency to protect CARES Act funds, like other government relief programs, and ensure funds go where they were originally intended.

“Millions of New Yorkers’ impacted by COVID-19 wake up every day uncertain about their ability to pay medical bills, buy groceries, or pay rent,” said Attorney General James. “The CARES Act was intended to serve the American peoples’ basic needs and provide a vital lifeline to all who have lost their jobs or seen their incomes reduced. The Treasury Department can stop suffering for millions of Americans by taking immediate action and protecting these payments before many of these payments go out.”

The CARES Act authorizes the Treasury Department to issue emergency stimulus payments of up to $1,200 for eligible adults and up to $500 for eligible children. Similar government relief programs intended to provide for Americans’ basic needs — like Social Security, disability, and veterans’ payments — all are statutorily exempt from garnishment, a legal mechanism that typically involves the “freezing” of funds in a bank account by creditors or debt collectors. But — in what was a likely oversight by Congress to quickly pass the law — the CARES Act does not explicitly designate these emergency stimulus payments as exempt from garnishment, allowing debt collectors to potentially benefit before consumers.

In their letter to Secretary Mnuchin today, Attorney General James and the coalition urge the secretary to use his authority under the CARES Act to stave off economic uncertainty for millions by immediately issuing regulation or guidance explicitly designating CARES Act “benefit payments” as funds that are exempt from garnishment.

“During this public health and economic crisis, the States do not believe that the billions of dollars appropriated by Congress to help keep hard-working Americans afloat should be subject to garnishment,” the attorneys general write. Continuing, “Treasury has stated that ‘[i]n the weeks immediately after the passage of the CARES Act, Americans will see fast and direct relief in the form of Economic Impact Payments,’ and we request Treasury’s assistance in ensuring Americans are able to retain that monetary relief.”

Attorney General James, as part of a coalition of 23 attorneys general, also sent a second letter today to the Consumer Financial Protection Bureau (CFPB), demanding the federal agency enforce the provision of the CARES Act that protects consumers who obtain relief under the Act from incurring harm to their credit scores, after the agency recently announced that it would not be enforcing the provision. The letter demands that the CFPB require both lenders and credit reporting agencies to meet their obligations under the Fair Credit Reporting Act during the COVID-19 crisis.

“If we hope to have a quick economic recovery when this crisis is over, American consumers must be fully equipped to reenter the market,” the attorneys general write. “The status of Americans’ credit reports will be vital to ensuring strong participation in the economy. The importance of protecting consumers’ credit is even greater during this crisis.”

Joining Attorney General James in signing today’s letter to the Treasury Department are the attorneys general of California, Colorado, Delaware, Hawaii, Illinois, Iowa, Maryland, Massachusetts, Maine, Michigan, Minnesota, Nevada, New Hampshire, New Jersey, New Mexico, North Carolina, Ohio, Oregon, Pennsylvania, Rhode Island, Vermont, Virginia, Washington, and Wisconsin, as well as the Hawaii Office of Consumer Protection.

Joining Attorney General James in signing today’s letter to the CFPB are the attorneys general of California, Colorado, Hawaii, Illinois, Iowa, Maine, Massachusetts, Michigan, Minnesota, Nevada, New Jersey, New Mexico, North Carolina, Oregon, Pennsylvania, Rhode Island, Vermont, Virginia, Washington, Wisconsin, the District of Columbia, and Puerto Rico.

These matters were handled by Assistant Attorney General Christopher L. McCall, Deputy Bureau Chief Laura J. Levine, and Bureau Chief Jane M. Azia — all of the Consumer Frauds and Protection Bureau. The Consumer Frauds and Protection Bureau is overseen by Chief Deputy Attorney General for Economic Justice Christopher D’Angelo and First Deputy Attorney General Jennifer Levy.