[Fraud News]

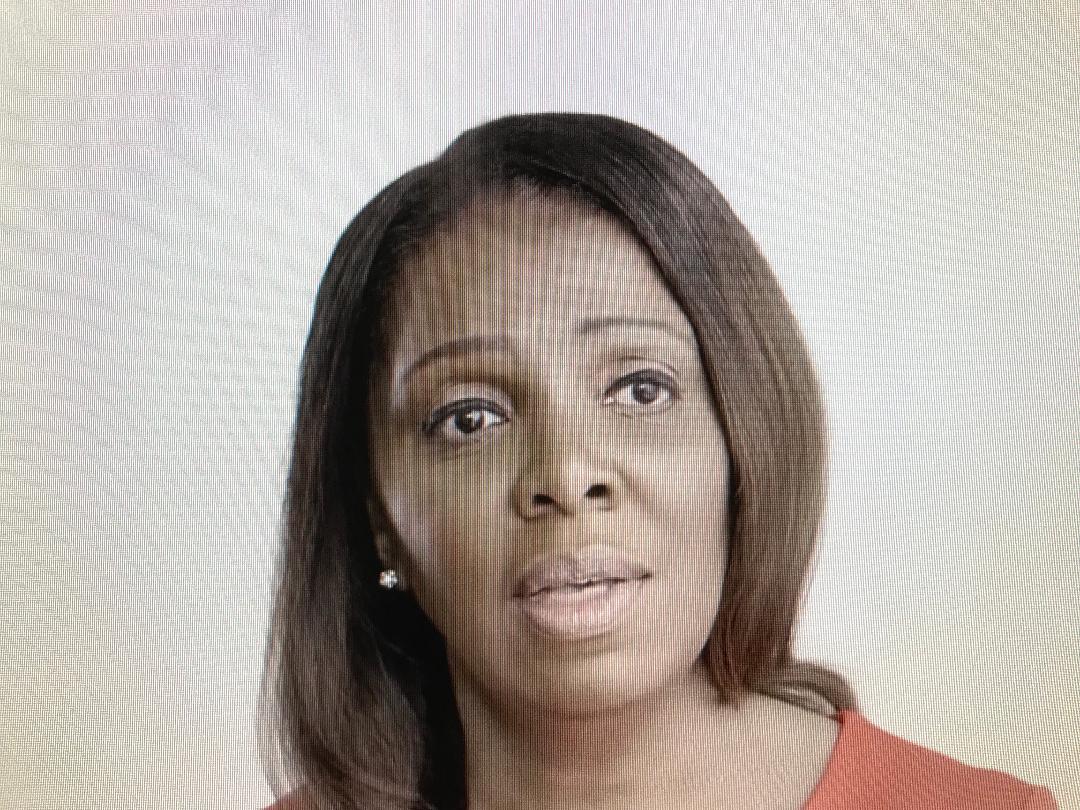

NY Attorney General Letitia James: “There is zero tolerance for individuals who use illegal and unconscionable tactics to cheat consumers out of their hard-earned money.”

Photo: Facebook

Attorney General Letitia James yesterday announced a settlement banning Buffalo-based debt collection kingpin Douglas MacKinnon, and his companies Northern Resolution Group, LLC and Enhanced Acquisitions, LLC, as well as Mark Gray and his company Delray Capital, LLC, from the debt collection industry, and requiring Defendants to pay more than $66 million in restitution and penalties.

MacKinnon, Gray, and their companies routinely inflated debts to try to collect more than consumers were legally obligated to pay. Collection offices working at the behest of MacKinnon and Gray used a variety of illegal tactics to obtain payments, such as threatening consumers with arrest.

“There is zero tolerance for individuals who use illegal and unconscionable tactics to cheat consumers out of their hard-earned money,” said Attorney General Letitia James. “Not only did the defendants force consumers to pay more than they owed, but they falsely threatened to have consumers arrested for not complying with these predatory practices. This settlement demonstrates our commitment to protecting consumers and I thank the CFPB for their partnership to stop this exploitative scheme.”

The New York Attorney General’s Office and the Consumer Financial Protection Bureau alleged that Defendants routinely caused $200 to be added to the debts they purchased and placed for collection. Collectors often demanded that consumers pay a further inflated price, a practice known as “overbiffing,” short for “over balance in full.” This resulted in consumers who borrowed only a few hundred dollars being hounded to pay thousands of dollars they did not legally owe.

Collectors falsely told consumers that they would be arrested for check fraud and threatened consumers with prosecution. Collectors used call spoofing to make it appear they were calling from government agencies and the court system. MacKinnon’s staff provided collection offices with access to an automated telephone dialer that enabled collectors to send threatening messages to hundreds of thousands of consumers. These messages contained many false threats, including claims that consumers would have their wages garnished, license revoked, and personal property taken if they did not pay.

Over the course of defendants’ scheme, over 250 collection shops collected on debts owned or controlled by Defendants. MacKinnon and Gray placed debt with collection shops throughout the country, but most offices were located in the Buffalo Niagara Region. MacKinnon and his staff served as the “corporate headquarters” that provided the debt, technology infrastructure, payment processing, and management for this vast illegal debt collection network. MacKinnon provided office space to collection shops and sent his staff to setup the cubicles, telephones, and computers necessary to operate. MacKinnon and his managers closely monitored the productivity of these collection shops and terminated offices that were not collecting aggressively enough.

Gray’s company Delray Capital, LLC, operated multiple debt collection offices in the Buffalo area that collected debts from consumers using illegal tactics. Gray personally received numerous complaints about the collectors’ illegal tactics but failed to put a stop to them. Gray also purchased debt portfolios and provided payment processing services in furtherance of Defendants’ scheme.

The settlement permanently bans MacKinnon and Gray and their defendant companies from the debt collection industry, and also prohibits them from misrepresenting material facts about financial-related products and services, profiting from customers’ personal information collected as part of the challenged practices, and failing to dispose of such information properly.

The settlement imposes a total judgment of $60 million against defendant MacKinnon, consisting of a $40 million judgment for consumer redress against MacKinnon and his defendant companies, jointly and severally. The settlement also imposes $20 million in civil monetary penalties against MacKinnon, with $10 million payable to the State of New York and $10 million payable to the CFPB. The settlement imposes a total judgment of $6 million against Defendant Gray. The settlement imposes a $4 million judgment for consumer redress against Defendants Gray and Delray Capital, LLC, jointly and severally, but this amount is suspended to $10,000 due to these Defendants’ inability to pay. The settlement also imposes $2 million in civil monetary penalties against Gray, but this amount is suspended due to Defendant Gray’s inability to pay. The full judgment will become due immediately if Defendants Gray or Delray Capital, LLC, are found to have misrepresented their financial condition. Once approved and signed by the court, the stipulated final judgments and orders settling this matter have the force of law.

This case is being handled by Assistant Attorney General Christopher L. Boyd in the Attorney General’s Buffalo Regional Office, with assistance from Senior Consumer Fraud Representative Karen Davis, Supervising Investigator Ken Peters and Investigator Jennifer Hill. The Buffalo Regional office is led by Assistant Attorney General-in-Charge Michael Russo. The Division of Regional Affairs is led by Deputy Attorney General for Regional Affairs Jill Faber.